Will we budge from 4% inflation rate?

Posted on March 31, 2023

The final piece of inflation data for February came this morning. We seem to be stuck on a 4% inflation rate. This post displays a table and four graphs that I use to see the trends in inflation.

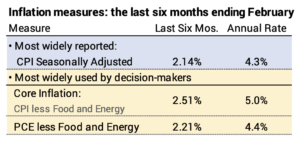

The two most widely-reported measures of inflation are Seasonally-adjusted inflation and Core inflation.

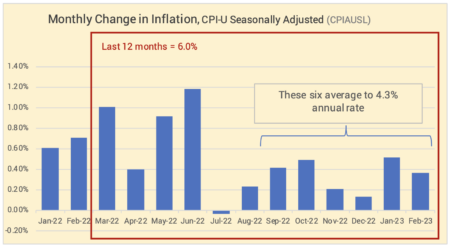

Seasonally-adjusted inflation increased by 0.4% in February. The rate over the last six months translates to an annual rate of 4.3%. Inflation over the past 12 months has been 6.0%. We would expect that historical rate to decline in the next several months, since March, May and June of 2022 averaged 1% inflation per month.

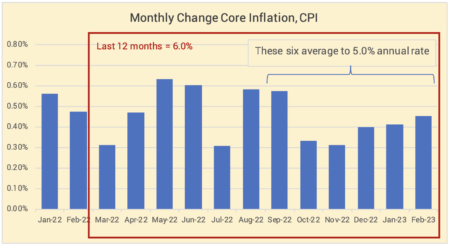

Core inflation excludes volatile energy and food components and was +0.45% for the month Inflation for the last six months translates to an annual rate of 5.0%.

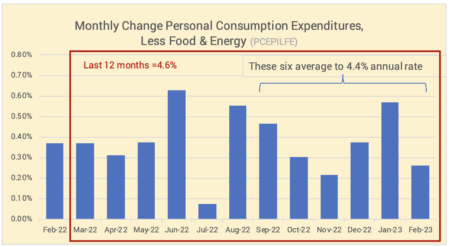

Personal Consumption Expenditures (PCE) excluding Food and Energy was issued this morning. This measure of inflation is one that the Federal Reserve Board favors. The increase this month was half that of last month. The last six months equate to 4.4% annual rate.

Over the last 12 months, inflation has been 6.4% as measured by CPI-U. This is a slight decline from last month. The historical 12-month rate has declined each month from its peak of 9.1% last June.

Conclusion: The annual rate of inflation, based on the six recent months of lower inflation, is about 4.5%. This is higher than the Federal Reserve’s target of 2% inflation and not much different than recent months.