Has Warren Buffet lost it?

Posted on March 24, 2023

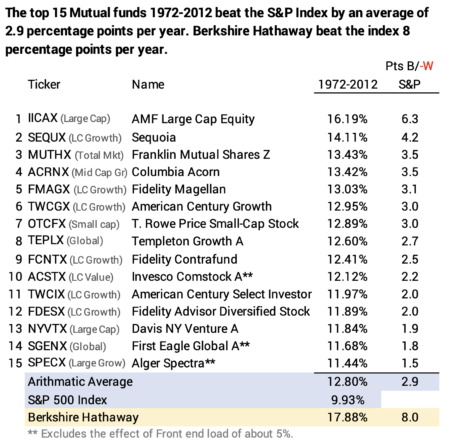

Warren Buffet has the best, longest record of stock picking in history. Berkshire Hathaway (BRK), a closed-end mutual fund in effect, outperformed the S&P 500 by eight percentage points per year for 40 years. But in the last 15, BRK has trailed the S&P 500 index by 1½ percentage points per year. Has Buffet lost his touch? Has the competition gotten that much harder, so he can’t find the bargain stocks like he did for decades? This post suggests it’s the latter: the top performing mutual funds that outperformed by 2.9 percentage points per year in the same 40 years have trailed the S&P by 2.5 percentage points in the last 15. Buffet knows: the most successful stock picker in history recommends that we stick with index funds.

== Last week’s post ==

I stated that its 15/16ths or 94% certain you will have more money in 20 years by investing in Index funds rather than Active funds. The article that provided the data stated that one reason why so few Active funds outperform is that the competition among professional managers is far tougher today than in the past: it’s a zero-sum game, and the targets for underperformance – the only source for overperformance – have shrunk.

== BRK and the top 15 for 40 years ==

I checked out the latest edition of Stocks for the Long Run by Jeremy Siegel, and he displays the performance of the top 15 mutual funds over the 40 years 1972-2012: they averaged 2.9 percentage points greater in annual return greater than the S&P 500 index for those 40 years. I do not know the number of mutual funds that have that long of history (There are more than 7,000 now), but I’d guess these 15 are the top 1% in performance.

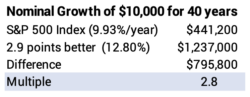

At 2.9 points better, an investment in 1971 grew to 2.8 times that that of the S&P 500, and the S&P grew 44-fold. Ah, the lure of Active funds! If only we could hold the fund that will be in the top 1% in performance. (I was lucky and owned Fidelity Contrafund, #9, starting in the 1980s; I have not owned it for at least the last eight years.)

Berkshire Hathaway’s (BRK) growth in value was 8 percentage points better per year than the S&P 500 for 40 years. An investment in 1972 more than 650-fold and 16 times the S&P 500. Wow. Seigel states the probability that that outperformance was luck is about one in a billion. Buffet has demonstrated the skill as the longest, most successful stock picker in history.

== The last 15 years ==

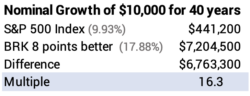

Those 15 top performers have averaged 2.6 percentage points per year worse over the last 15 years. Two of the 15 have averaged more than the S&P 500. The best performer is a Large Cap Growth fund, and it did not match its peer index over the 15 years.

Berkshire Hathaway has lagged the S&P 500 by 1.5 percentage points per year. If you invested in BRK 15 years ago, you’d have 9% less than if you invested in an S&P 500 index fund.

Conclusion. This post supports the argument that the competition among Active fund managers is a lot tougher than it was 40 years ago. The top 15 Active mutual funds from 1972-2012 outperformed the S&P 500 index by an average of 2.9 percentage points per year, but in the last 15 years, the 15 have lagged the Index by 2.5 percentage points per year. The shift for Warren Buffet and Berkshire-Hathaway is more dramatic: 8 points better per year for 40 years but 1½ points worse per year in the last 15.

Stick with Buffet’s advice: invest in Index funds.