When will we budge from 4% inflation rate?

Posted on April 28, 2023

This post shows that we continue to track to 4% inflation, twice the Federal Reserve’s target. Why do I track inflation? I track the recent trends in inflation since high inflation hurts the ability of companies to earn appropriate returns. Efforts to stamp out inflation will stunt the growth of our economy and corporate profits. High inflation consumes spending power of our portfolios, lowering our chances of increased annual Safe Spending Amounts (SSAs, Chapter 2, Nest Egg Care (NEC).

Going deeper: I display a table and the same four graphs that I’ve use to follow the trends in inflation. I add two more this month. This was a good article this week.

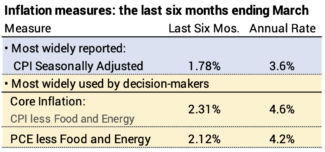

The two most widely-reported measures of inflation are Seasonally-adjusted inflation and Core inflation.

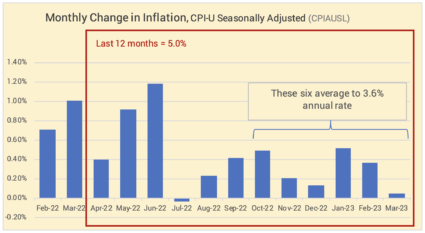

Seasonally-adjusted inflation increased by 0.05% in March. The rate over the last six months translates to an annual rate of 3.6%. We would expect that the 5.6% historical 12-month rate to decline in the next three months, since April, May and June of 2022 averaged 0.8% inflation per month.

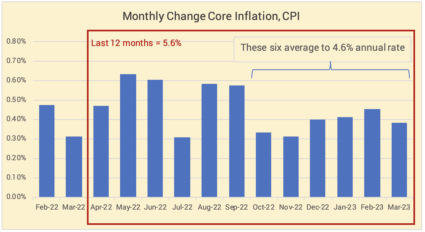

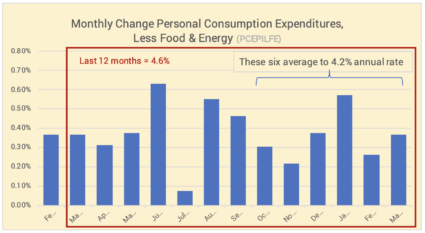

Core inflation excludes volatile energy and food components. The level and trend are more stubborn. Inflation was +0.4% for the month, and inflation for the last six months translates to an annual rate of 4.6%.

Personal Consumption Expenditures (PCE) excluding Food and Energy was issued this morning. This measure of inflation is one that the Federal Reserve Board favors. The increase for March was greater than February. The last six months equate to 4.2% annual rate.

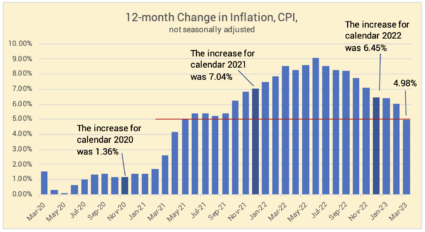

== History of 12-month inflation ==

Full year inflation measured by the CPI-U shows that inflation for the last 12 months has been 5%. This is a one percentage point decline from last month. The historical 12-month rate has declined each month from its peak of 9.1% last June.

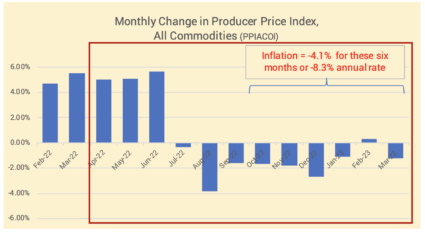

== Producer’s Price Index ==

I add this graph. The change in producer prices will impact consumer inflation. PPI over the last six months is below 0%.

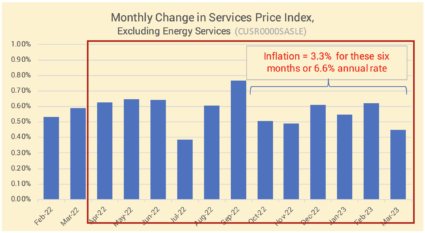

== Services ==

Inflation for services is running fairly steadily at +6% annual rate.

Conclusion: The Core rate of inflation increased by 0.4% in March. Based on the recent six months, the annual rate of inflation is about 4%. This is basically unchanged from last month. Other indicators of inflation are mixed: the producers price index for goods is running no greater than 0% while the services price index is running in excess 6%.