What’s the news on inflation?

Posted on October 14, 2022

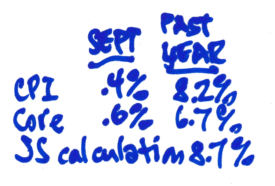

New data on inflation came out yesterday, and the US stocks jumped about +2.5%. I have no idea why, but I’ll take it: last month stocks dropped about 4% on what looks like very similar news to me. This post summarizes the inflation data: 1) The gross increase in Social Security (SS) benefits in 2023 will be +8.7%. 2) Monthly seasonally-adjusted inflation for September was 0.4%, more than the last two months; this measure of inflation over the past 12 months has been 8.2%; 3) Core inflation for September – inflation less the volatile energy and food components – was .6%, about the same as recent months; core inflation over the last 12 months has been 6.7%

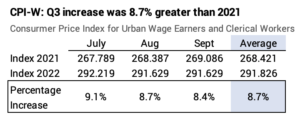

= Gross Social Security Benefits +8.7% ==

SS announced that the gross benefit will increase by 8.7% for payments in 2023. SS calculates COLA based on the average increase in Q3 of this year from using a measure CPI-W. See here. This table summarizes the detail calculation:

You will have a slightly greater increase than an 8.7%. Most all of us retirees have Medicare premiums deducted from our Social Security benefit. Medicare announced those premiums last month, and Medicare Part B premiums will decrease by about $60 per year for each on Medicare.

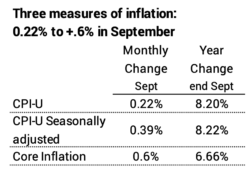

== Seasonally-adjusted CPI: 0.4% for September ==

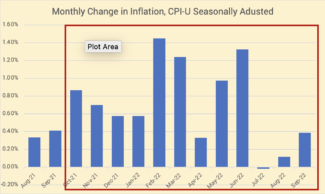

The increase in September was 0.39%. This was greater than the last two months. It was about the same increase as in September 2021, meaning the historical annual change this past month did not change from last month: 8.2%.

You can see from the chart, upcoming months are those with very high inflation in 2021. One would hope we beat those months and historical annual inflation will drop steeply.

== Core Inflation: 0.6% for September ==

Core inflation was 0.6% for the month, similar to recent months. It’s stubborn. The monthly rate is not decreasing. The increase this month was greater than in September 2021 meaning the inflation for the past 12-months increased to 6.7%.

Core inflation is lower than the other measures since over the last year food prices have increased 11.2% and energy prices have increased 19.8% . In September, food prices increased 0.8% and energy prices decreased 2.2%.

Conclusion: We retirees have to be concerned about inflation. It’s eaten a big chunk of the spending power of our portfolio. High inflation means the very poor returns for stocks and bonds are really much worse than they appear. This blog post updates the information from last month. Inflation rates look similar over the last three months, and I don’t see much of a decline, especially in Core inflation the measure that excludes volatile food and energy components of the calculation.