What changes in your financial retirement plan when a spouse dies?

Posted on August 20, 2021

What changes in your financial retirement plan and, most importantly, how is the surviving spouse’s financial well-being affected when one spouse dies? This purpose of this post is to describe the key changes as I see them. The key point is that the surviving spouse’s Safe Spending Amount (SSA; Chapter 2, Nest Egg Care [NEC]) will at least be the same as if both of you were alive. I conclude that Patti will be just fine in the future after I die.

== Expenses will decrease ==

Expenses for one will be lower than for two; that should be obvious. I estimated our routine spending in this post. If it was just one of us, the major expenses that would decline are car (sell the second car for cash; pay no annual insurance or on-going expenses), food (not an insignificant amount!), and airfares on travel. My rough estimate is that these lower expenses roughly match the effects of lower Social Security income.

== Social Security benefits will decrease ==

If both collect Social Security, and one spouse dies, the surviving spouse retains the highest benefit and foregoes the lowest benefit. Example: Patti and I both receive Social Security benefits. One is ~70% greater than the other or +60% of the total. If one of us dies, the other will retain the higher benefit and not the lower benefit: the gross Social Security benefit will decline by about 40%.

You may have other distributions from a defined benefit plan or other sources of income that will change on the death of one of you. For Patti and me, the changes would not be significant.

== SSA will not decrease ==

The Safe Spending Amount that you now pay from your nest egg for spending in a year will not decrease. Depending on which spouse dies first, it could increase.

Your SSA is your Safe Spending Rate (SSR%) times your Investment Portfolio. (See Chapter 2, NEC). SSR% is determined by the number of years you choose for ZERO CHANCE of depleting your Investment Portfolio in the face of the MOST HORRIBLE sequence of stock and bond returns in history.

Patti and I decided to use her longer life expectancy for our choice of the number of years we wanted for ZERO CHANCE of depleting our Investment Portfolio. (See Chapter 3, NEC.) That choice set our initial SSR%, and the logic of using her life expectancy sets all our future age-appropriate SSR%s. I use the appropriate SSR% in the calculation that tells me if our SSA increases in real spending power for the next spending-year or simply adjusts for inflation.

If I die first, nothing changes: Patti uses the same SSR%s that we have already scheduled for all years in the future. If Patti dies first, I’d reset the SSR% schedule based on my life expectancy: I’d use a greater SSR% than we now have scheduled.

Example: At the start of our plan in December 2014, Patti’s life expectancy was 19 years. Nineteen years for ZERO CHANCE for depleting an Investment Portfolio translates to an initial SSR% of 4.40% – $44,000 spending power per $1 million initial Investment Portfolio. (See Appendix D, NEC.) My life expectancy at the time was 14 years; that would have translated to a higher SSR%.

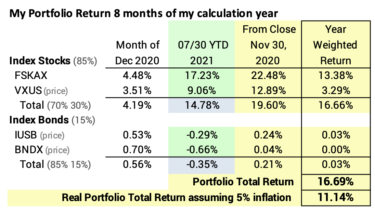

It’s now mid 2021, almost seven years later. We use the age-adjusted SSR% – based on Patti’s life expectancy – that I’ve laid out on my calculation sheet in this post. That was 4.85% last November 30; Patti’s life expectancy from the Social Security calculator then rounded to 15 years. I will test to see if I can use 5.05% this December; her life expectancy then rounds to 14 years.

If I die first, NOTHING CHANGES in Patti’s calculation of SSA. The age-adjusted SSR%s do not change for any future year. My retirement accounts first pass to Patti; our taxable accounts are held jointly; therefore, our total Investment Portfolio does not change. She can pay herself the same SSA that we both would have received.

If Patti dies first, then I’d use my shorter life expectancy to set a new schedule of SSR%. If Patti died now, I’d use the SSR% associated with my 11-year life expectancy for the calculation this November 30 – 5.80% (See Appendix D, NEC). It looks like our portfolio will earn far more than we withdrew for our spending last year (4.85%). That tells me that I’d use the new, greater SSR% to calculate spending for 2022. If that still holds to the end of November, my SSA for spending in 2022 would be 23% greater than if would be if it is the two of us or just Patti alive [(5.80%-5.05%)/5.05%)].

== Taxes will increase but will not damage ==

The surviving spouse will pay more total tax than the married couple. Even though the Social Security benefit declines, Patti’s total income will roughly 80% of the total for the two of us. That will result in higher taxes because higher marginal tax brackets start at half the income for a single taxpayer as for a joint, married taxpayer: more of the total is taxed at higher marginal rates. Also, the tripwires that result in increases in Medicare Premiums are half the total income as for a joint, married tax payers.

I worked through this for Patti and me as a single taxpayer relative to us as married, joint filers and find the increased taxes are meddlesome – the surviving taxpayer will pay perhaps a couple of $1,000 in higher income tax than the two of us pay now and would cross a Medicare tripwire that the two of us do not cross. (I give a specific example in next week’s post.)

I conclude Patti clearly have enough for spending after taxes each year to enjoy the money we worked so hard to accumulate. She’s may judge that she has More-than-Enough. (See Chapters 5 and 10, NEC.)

== With planning, the survivor can lower taxes ==

If one is a stickler like I am, it is more important to take an annual snapshot of a tax plan, like I did here two weeks ago with this spreadsheet. My Roth will be more valuable to the survivor of us, because there will be more annual opportunities to avoid taxes that he/she does not need to pay: added Medicare premiums and higher marginal tax rates than we paid to contribute to Roth.

I’d likely do that annual tax planning; I like those details and finding if I can completely avoid paying a tax. Patti REALLY likes to save money, but she’s not a spreadsheet person. I think she is up to learning how to save perhaps $1,000 per year, though. That’s much more than she saves on another set of plastic food containers – that we don’t need – from The Dollar Store!

Conclusion: If you follow the plan in Nest Egg Care and you are a couple, I conclude you can be comfortable thinking that the survivor will be just fine in the future. Expenses will decline. Some income will decline – Social Security benefits are the key example. Total taxes paid on the same sources for SSA will be higher for a single taxpayer than they were for married, joint filers. But, most importantly, the Safe Spending Amount you pay yourselves now will be the same for the survivor in the future. SSA never declines; it can only get better. I am not at all concerned about Patti’s financial future if I die.