We added a data point that points to lower inflation.

Posted on July 28, 2023

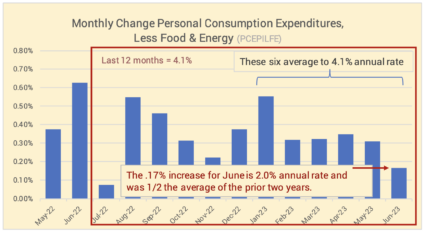

A final data point for June inflation was issued this morning. The important chart below is the one for Personal Consumption Expenditures, a measure the Fed favors. June was at a rate of equal to 2% annual inflation; this is lower than in the recent past. The data point confirms the June reading for Core Inflation that I described two weeks ago. One month does not make a trend, but this is a bit of encouraging news. The market is reacting positively today, and July will be a good month for stocks – up about 3%.

Going deeper: below I display a table and the same six graphs that I’ve use to follow the trends in inflation.

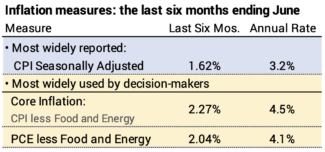

The two most widely-reported measures of inflation are Seasonally-adjusted inflation and Core inflation.

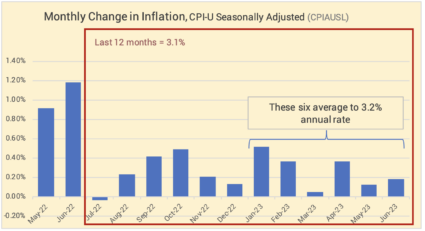

Seasonally-adjusted inflation increased by 0.18% in June. The rate over the last six months translates to an annual rate of 3.2%. Inflation over the past 12 months has been 3.1%.

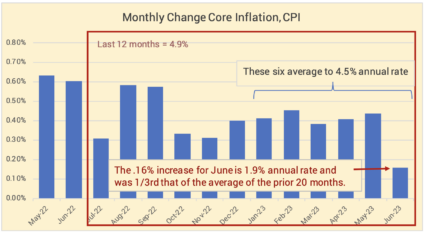

Core inflation excludes volatile energy and food components. June broke with the pattern that was aimed at ~5% inflation. Inflation in June was +0.16% for the month, about a third that of the prior 20 months. June inflation is at a rate of 1.9% per year.

Personal Consumption Expenditures (PCE) excluding Food and Energy was issued this morning. This measure of inflation is one that the Federal Reserve Board favors. The increase this month was 0.17%. This is about half the average of the prior two years. That one month is at a rate of 2.0% per year.

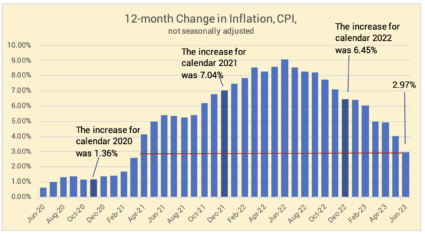

== History of 12-month inflation ==

Full year inflation measured by the CPI-U shows that inflation for the last 12 months has been 3.0%. The historical 12-month rate has declined each of the past 12 months from its peak of 9.1% last June.

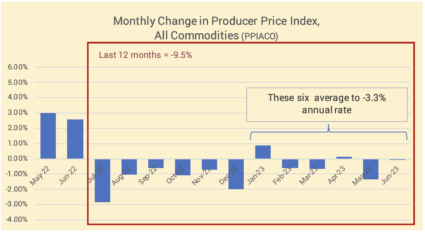

== Producer’s Price Index ==

The change in producer prices will impact consumer inflation. PPI over the last six months is at a -3.3%. annual rate.

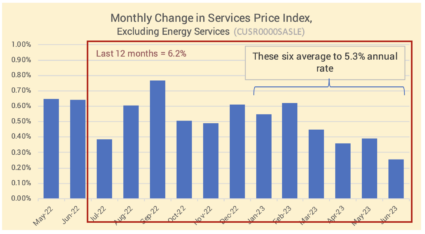

== Services ==

Inflation for services is trending slightly downward. The last six months are at at 5.2% annual rate.

Conclusion: The Core rate of inflation in June was 0.16%. This was about 1/3rd the average of the prior 20 months. The annual rate of inflation, based on the six recent months of lower inflation is about 4.5%. The low inflation for June was repeated in the index of Personal Consumption Expenditures; inflation in June was about half the average of the past two years.