Should you buy an I-bond now – or keep the one you bought last year?

Posted on May 5, 2023

Treasury announced the six-month rate that applies to I-bonds – bonds with an interest rate that adjusts for current inflation. The rate of 4.3% APR applies to bond you buy between now and the end of October; the rate applies for six-months if you already own an I-bond. That rate does not excite me. It’s less than my current money market rate. You may want to follow my thinking on this: I see no reason buy a new I-bond. I therefore I have no reason to hold the I-bond that I bought last May 20. I’ll redeem mine on August 20.

The longer story:

== I-bonds ==

• You can buy $10,000 per year per taxpayer.

• You buy directly from the US Treasury at this site. Your I-bond is held there, and you will redeem it from this site. I set up a transfer from my checking account to buy the bonds and the proceeds will return to my checking account.

• You earn interest each six months that you hold your bond at a rate that is revised every May 1 and Nov 1. I-bond interest is added to your principal value at the end of each six months to yield a new principal balance.

• You must hold it for one year from the date you bought it to earn any interest.

• When you redeem your bond earlier than five years, you forgo three months of interest: you want to sell when the interest rate you would otherwise earn is not that exciting; you don’t want to hold it and earn interest at a rate you find unattractive.

• You can report all of your interest income earned in the year when you redeem the bond.

== The 4.3% rate isn’t attractive to me ==

My recent, seven-day money market rate is 4.5%. I suspect it isn’t declining any time soon. I would not buy an I-bond at the 4.3% rate, and therefore I should not continue to hold it to earn this rate. I do want to hold my bond long enough to earn – not give up – interest at the last rate of 6.9%.

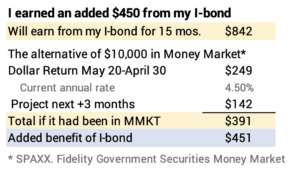

== I’ll earn $842 when I sell ==

I will earn $842 on the I-bond that I purchased on May 20, 2022 if I sell it on or shortly after August 20, 2023. I will forego the relatively lower interest earned in May, June and July. That $842 for 15 months works out to a 6.7% annual return rate.

== I made an added ~$450 ==

Was this a good deal? It depends on where I got the $10,000 to buy the I-bond. I really didn’t have an extra $10,000 sloshing around; I eventually had to sell bonds later in the year to replenish the cash I had set aside for spending in 2022. I sold bonds – shares of my IUSB – at what now looks to be a low point. I complained here.

But for this comparison, I’ll assume I used $10,000 that would have otherwise earned money market rates. I estimate that my I-bond will earn and added $450 relative to the alternative of having kept $10,000 in money market for 15 months.

That’s nice, but I think this is a one-time event for me. I hope inflation ebbs – meaning that I-bond interest rates lower in the future – such that I don’t have to be tempted to buy an I-bond in the future.

Conclusion: The I-bond interest rate has declined to 4.3% APR. The 4.3% rate is less than I currently earn on my money market. I conclude I would not buy an I-bond at that rate and that tells me that I don’t want to hold my I-bond to earn at that rate. I plan redeem the $10,000 I-bond I purchased last May 20 shortly after August 20: I keep all the $842 interest earned in the last 12-months. I made perhaps $450 more with the I-bond than I otherwise would have made, but it was a bit painful of experience for me.