What did Nest Eggers score in calendar 2017?

Posted on January 5, 2018

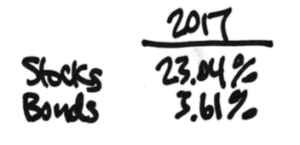

Fellow Nest Egg Team members: you should be happy with our team’s scoring for last calendar year ending December 31. Our team had a very good year. If you followed the recommendations in Nest Egg Care, you came out with handsome results. As in all prior years, our scoring is solidly above the average of others (funds and investors). (You’ll see added support for this assertion in an upcoming post.) Here are our team’s scoring results.*

Your combined return for stocks plus bonds might differ from mine based on your decision on mix of stocks and bonds. You are still above average for all those who chose a similar mix.

As mentioned in previous posts (here and here), your return rate for your 12-month period (for the date you pick for your Recalculation) exceeded the Safe Spending Rate you used last year. That obviously means you have more now than you did then, and you can (or have already decided to) ratchet up to a new Safe Spending Amount for 2018. (You could have decided to lop off some of the More-Than-Enough as gifts now, like Alice did).

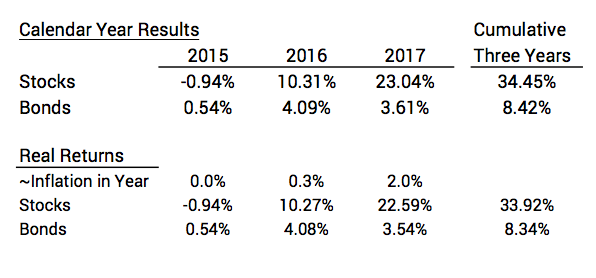

Just for reference, I could also display the result for prior calendar years, and that would look like this since 2015.

Conclusion. 2017 was a good year – well above expected the return rate for stocks (6.4% real) and for bonds (2.6% real). Our team was above average for all others (funds and investors), just as it is in all years. Our combined return rate for stocks and bonds meant all of us had more money when we recalculated for our Safe Spending Amount (SSA) for 2018. We all could ratchet up to a greater spending amount (or gift more now). In essence, all of us are starting on a new financial retirement plan (hockey stick) for 2018.

* Your results may differ by a small amount depending on your choice of fund and your weights between US and International. Your returns on your Recalculation date (e.g, October 31 or November 30) would differ.

Note: On Jan. 15, I updated the numbers in the displays to correct for small errors I recorded for return rates. The biggest change lowered 2017 Bond returns by .16%. Cumulative three-year returns were slightly greater for both stocks and bonds.