How much more will you pay for Medicare Premiums in 2022?

Posted on November 19, 2021

Those of us on Medicare pay Part B (medical insurance) and Part D (prescription drug) premiums directly to Medicare. If you receive Social Security like Patti and me, your premium is deducted from your gross Social Security benefit. This post describes the premium increases you’ll pay in 2022 and the income thresholds from your 2019 tax return that you filed by April 15, 2020 that can trigger higher Medicare premiums.

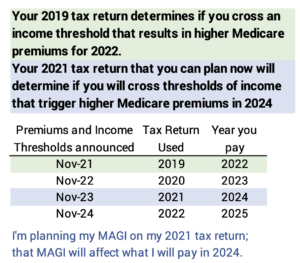

I use the income thresholds stated now as a guide to my final tax planning that I do this week for my 2021 tax return. I’ll sell securties in about ten days to get the cash for our Safe Spending Amount for 2022 (SSA; see Chapter 2, Nest Egg Care.) I get a close estimate of my total income – Adjusted Gross Income – for 2021. I’ll have a good idea of how close I am to the current thresholds that trigger higher Medicare premiums. But I won’t know in detail since there’s a lag: my total income on our 2021 return will determine if we will pay premium increases in 2024, and those thresholds won’t be announced until November 2023. But if I stay under a current threshold, I’ll be under a future threshold.

You also need to plan where you will get your cash for your spending. You want to estimate your total income for the year, and you want to compare that to the income thresholds just announced. You don’t want to carelessly cross an income threshold on your 2021 tax return that would result in higher Medicare premiums in 2024.

== Part B: 14% increase ==

We all pay at least the same minimum Part B premium, which increased 14% from about $148 per month to about $170 per month – to a total increase of about $260 per year. That’s not a deal breaker for all of us with a nest egg, but that $22 increase in cost is more than the cost of living adjustment from Social Security for the average recipient. The minimum Part D premium you pay is based on the plan you’ve chosen. These are two good detailed explanations: here and here.

== Triggers of higher premiums ==

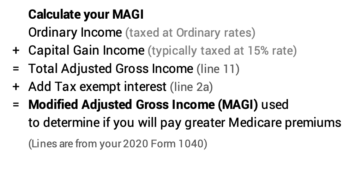

Your your MAGI – Modified Adjusted Gross Income – on your 2019 tax return (You’ll filed that in the spring of 2020. ) determines if you pay more Medicare premiums for 2022. Five thresholds result in greater Medicare premiums. Each threshold is a tripwire. Cross a tripwire by $1 and you pay the added premium. For this next year, a person with REALLY HIGH income in 2019 who blew by all five tripwires will pay about $6,000 more; $12,000 more for a couple.

This year Medicare inflation-adjusted the thresholds of income that trigger higher premium payments and states it will adjust the thresholds for inflation in the future. This is a new, good process; thresholds did not adjust each year, meaning that inflation alone was pushing us towards higher premiums.

== Current thresholds are my guide ==

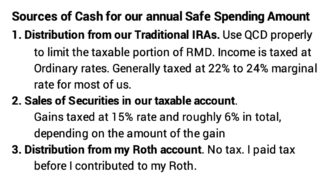

I use the current thresholds as a guide to my tax planning now for my 2021 return, even though I know they’ll inflation adjust in future years. I’ll calculate our Safe Spending Amount (SSA) for 2022 in less than two weeks. I’ll finalize my plan as to where I will get the cash that I’ll have by the end of December. I have three sources for cash. Each source has a different tax consequence. My choices determine our MAGI for our 2021 tax return. I may be able to adjust the source of our SSA to avoid crossing a threshold that would result in higher premiums. See recent blog posts here and here.

Conclusion: This week Medicare announced premium increases for 2022. The increase was 14% for the base, Part B (medical insurance) premium. That’s greater than the 5.9% Cost of Living Adjustment for the gross Social Security benefits for 2022. All of us who receive Social Security and are on Medicare will see less than 5.9% net increase.

Medicare also announced the income levels on your 2019 tax return that can trigger higher premiums that you would pay in 2022. Cross a threshold or tripwire by $1 of income and you can pay $1,000 or even $1,000s more. I keep those tripwires in mind for my planning now on our 2021 tax return. I can adjust our taxable income when I decide my of mix of three basic sources for cash for our upcoming annual Safe Spending Amount (SSA).