How do you look at your portfolio now?

Posted on March 20, 2020

This has been another stressful week. I can’t break the habit of looking at my portfolio, but I think I’ve been able to narrow what I look at. There’s a big part of my portfolio I don’t want to look at very often: we all know what that is. I play a number of mind games to look at my portfolio differently. Here’s a mind game I play every December. And this is my newest. I want to put the blinders on and just look at our insurance: cash and bonds. This is a mind game, a trick. But we need all the tricks we can come up with to stay calm at times like this. The purpose of this post is to describe this mind game.

== Bonds are Insurance ==.

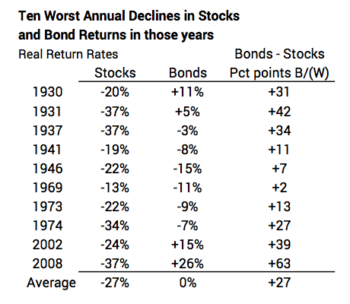

I’ve said this in a number of posts, but it’s always worth restating. I never bore of drilling this deeper and deeper into my head: we own bonds as insurance against disastrous declines in stocks. That’s it. We sell bonds, not stocks, when stocks have cratered. Bonds may decline, but they decline MUCH LESS when stocks crater. This table shows the ten worst calendar-year returns for stocks since 1926. Bonds always were better than stocks in all those years and averaged 27 percentage points better. Bonds are insurance.

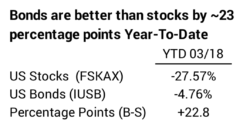

Here it is this year to date. Same thing. Bonds are ~23 percentage points better than stocks. Bonds are insurance. Get it?

== I moved some bonds to cash ==

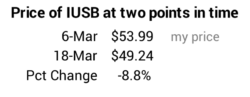

I improved the quality of our insurance two weeks ago. Bonds were at an all-time high. I locked in the price for bonds that I might want to sell in December. That’s the time of year I get our spending for the upcoming calendar year – 2021 – into cash. In hindsight, my sell price of $53.99 looks good. The price now is about 9% lower. That decline is been nothing like the fall for stocks. It’s still a good time to sell bonds, in my opinion.

== I want to only look at our insurance ==

This is my newest mind game: I just want to reinforce, restate, and focus on my insurance at times like this. I want don’t want to think about stocks. How much Cash + Bonds do I have? How long will my insurance carry me?

Our money is at Fidelity. Fidelity recently changed the first page I see after I log in. The display gives me the option of quickly displaying our total portfolio by Account position – meaning by security.

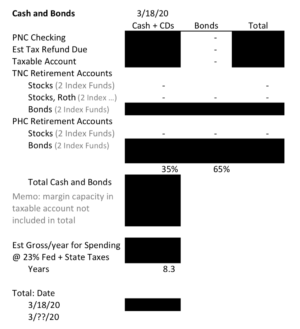

I make that choice on the display above and I see the long list of positions by account. I can go down quickly enter the totals for cash and for bonds for each account on a spreadsheet that I display below. (I’ve blacked out our actual $$$ figures.) I want to do this quickly so I am not tempted to look and make a similar spreadsheet for stocks. That’s last thing I want to do. My spreadsheet adds the totals for cash and bonds. I can enter the total for each date, and I can track that over time.

My sheet shows we have eight years of spending in Cash + Bonds, and about three of those years are in cash. To get to the number of years, I divided the total by a bit less than Safe Spending Amount that I calculated last December. I’m not being stingy. The amount includes lots of discretionary travel, and I’m not sure when I think that is coming back. But I now know the number years I have before we’ve totally run out of cash and bonds and MUST sell stocks. Eight and more if we spend less.

That would mean I’ve totally depleted our off-the-top Reserve (Nest Egg Care, Chapters 1 and 7) and preferentially sold ALL our bonds in our Investment Portfolio (Chapter 1). The only thing we have left is stocks. That is DRASTIC, but with those assumptions, I know we can weather this storm.

Conclusion. We should look at our portfolio in a number of ways that help isolate our brains from wild swings in our portfolio value. We need to pull out all the tricks at times like these. My latest mind game is to just look at the cash and bonds. I want to reinforce in my brain that the total is our insurance. I divide the total of cash and bonds by our approximate annual spending. That tells me how many years we could wait before we had to sell stocks. It’s many. If you’ve followed a plan in Nest Egg Care, you have many years before you’d have to sell stocks.