Do you have the mindset to be in the top 2% of all investors?

Posted on August 11, 2023

What’s the correct mindset in the Save and Invest Phase of life? That’s up to roughly age 55 or 60. That’s the start of the transition to your Spend and Invest Phase of life that I assume starts at age 65. The focus then is not to outlive our money, and our mindset then must be very different; I’ll discuss the major differences in a future post.

Your objective in your Save and Invest phase of life is to invest with the most reliable chance for More in the future. You want each investment you make to be reliably More when you sell it for your spending. You particularly want to have More near the start of your Spend and Invest phase. That’s going to determine how much you can safely spend from your portfolio for the rest of your life. Follow the advice in this post and you will be in the top ranks of investors in your Save and Invest phase of life. Perhaps only one in 50 will have greater returns than you.

Think that each annual amount you save and invest has a holding period – the number of years you hold on to an investment before you will sell if for your spending. You will have relatively short holding periods and very long holding periods. When you are saving for a down payment on a home in the next five years, your most reliable chance for More – more specifically, your lowest chance for Less – is to keep your money in money market or CDs. No stocks.

The money you contribute to your retirement plan has very long holding periods. You’ll hold each annual amount you save and invest in your 20s for nearly 40 years. You’ll hold the investments you make for retirement in your 30s for nearly 30 years.

Think of the amount you save and invest this year as a gift that you will open many years in the future. You’ll make perhaps 40 gifts up to age 65, and you’ll open those gifts for perhaps 20 years when you are retired.

It’s not precise, but I think it’s simpler to think that all the gifts you make in this phase have a 25-year holding period. The gift you make at age 40 is the gift you will open in your 65th year. The gift you make at age 41 is the gift you will open in your 66th year. And so on.

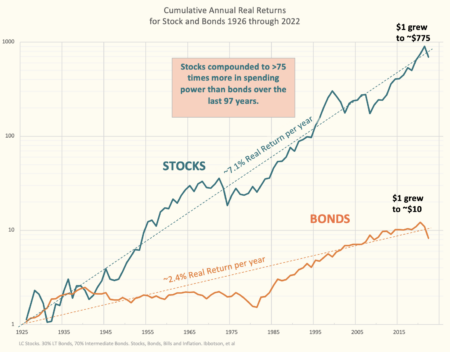

All gifts of 25 years (actually far fewer than 25) must solely be invested in stocks. Stocks are the CERTAIN path to More. Any bonds you hold will result in less in total. Stocks have never declined over 25 years. On average stocks return 3.3 times that of bonds. Bonds have never outperformed stocks in any 25-year holding period; stocks were 10% better than bonds in the 25-year period that bonds came closest to stocks. This description tells the obvious advantage of stocks.

You will only achieve the results you want by investing in broad-based index funds. You won’t achieve them by trying to beat the market. The results cited assume you match the market returns less a very low expense ratio – the annual percentage costs you incur that is a deduction from gross market returns. Attempts to beat the market – invest in higher cost actively managed mutual funds that tell you that they will outperform, for example – fail in 15 of 16 chances and on average lower the amount you have in the future by about 13%. That’s 13% less per year that you’ll be able to safely spend when retired.

Save in retirement accounts. The benefit of tax-free growth will be about 15% more after taxes. ALWAYS contribute to your employer’s plan to get the FREE MONEY match it may offer. You are doubling your return on that portion of your contribution.

You must tell yourself that you have correctly invested each annual gift. The ride with stocks-only will be bumpy. Bumpy is too kind of a word for some years or periods. Downturns in stocks can be scary. Your intuitive, emotional brain will try to overrule your rational, thinking brain. You must remind yourself that each annual gift is correctly invested for More. My last 35-year gift grew 12.5X in real spending power. It rode through the 2nd and 5th worst one-year declines for stocks in history; the 3rd worst three-year decline; the 3rd longest period of 0% cumulative return for stocks.

You want to be a self-sufficient investor and hold just two broad-based mutual funds and only pay the expense ratio of those two funds. I hold a US Total Stock Market Index Fund (70% of my total for stocks) and an International Total Stock Market Index Fund (30%). Those two own pieces of almost all traded stocks in the world. Those are the only two I will hold for the rest of my life. My total expense ratio is less than .03%. I keep +99.5% of market returns.

Conclusion. With the right mindset you will be in the top ranks of investors in your Save & Invest phase of life. Perhaps only one in 50 investors will have greater returns than you.

The right mindset focuses on investing for reliably More Money for a holding period – the number of years you hold an investment before you sell it for your spending. Important targets – saving for a down payment for your first home – will have relative short holding periods. Your most reliable path to More – specifically, the least chance for Less – is to invest in CDs and money market. No stocks.

The amount you save and invest for your retirement has very long holding periods. Think that you’ll hold the amount you save and invest this year in your retirement account as a gift to the older you. You’ll make perhaps 40 annual gifts up to retirement, you’ll open those gifts over about 20 years in retirement.

All 25-year gifts (and gifts with a lot fewer years) MUST be invested 100% in stocks. Stocks are the CERTAIN path to More. Stocks have ALWAYS increased in 25 years. Stocks have ALWAYS outperformed bonds – 3.3 times more than bonds on average. You can expect annual each gift invested in stocks that you’ll open in retirement will have grown six-fold in real spending power in 25 years.

You must invest in broad-based stock index funds. You will almost certainly fail to beat the results of index funds if you attempt to beat the market: that tactic fails 15 of 16 chances and typically leads 13% less if you held than just held two stock index funds.