Do you have check writing for your retirement account?

Posted on October 25, 2019

If you are over 70½ you want to make contributions from your retirement accounts using QCD – Qualified Charitable Distributions. I wrote about this a year ago. You get the full tax benefit of donations when you make them from your retirement account. You get no tax benefit from donations from your checking account because you will – almost certainly – use the $13,500 Standard Deduction per individual on your tax return; you won’t itemize donations on Schedule A as a deduction from income. This post describes the mechanics Patti and I follow for making donations from our retirement accounts.

== The Tax Benefit of QCD ==

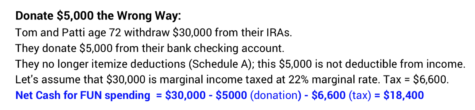

Failure to use QCD is a big mistake. Here is an example of the wrong way to donate when you are over 70½ and subject to RMD. In this example, Patti and I receive no tax benefit from a $5,000 donation.

Here is the right way. In this example the $5,000 of QCD results $1,100 lower taxes. Using QCD gave 22 cents back on each dollar donated. Failure to use QCD is the same as throwing away 22 cents of every dollar donated.

== Donating from our 2019 SSA using QCD ==

I describe these steps, since my brain struggled a bit with the cash flow implications when we first did this.

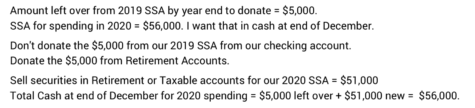

This is the time of year that Patti and I decide the amount we will donate to each charity and the total. Our spending tends to decrease in the fall. Our monthly deposits from our nest egg continue into our checking account. Our checkbook balance increases. Let’s assume we think $5,000 will be available in December for donations to charities.

I also have a good handle on what our Safe Spending Amount (SSA) will be for 2020; unless the market goes crazy UP in the next five weeks – our Recalculation uses returns for the 12 months ending November 30 – it will be our 2019 SSA increased for inflation. That’s the Social Security cost of living adjustment recently announced: 1.6% for 2020. Let’s assume our 2020 SSA will be about $56,000 net after withholding taxes.

How do I correctly donate before year end and wind up with $56,000 in cash – money market; CDs or short-term bonds – at the end of December? That’s the money I’ll use for monthly deposits in our checking account in 2020.

I don’t donate from what’s left of our 2019 SSA from our bank checking account. I sell securities in our retirement account and donate $5,000 as QCD. I also sell $51,000 of securities from our retirement accounts and from our taxable accounts that goes to our 2020 SSA. The $56,000 SSA for 2020 in cash by the end of December is $5,000 from what’s left over from 2019 + $51,000 new.

== Detailed Mechanics of check writing ==

Patti and I have our retirement accounts at Fidelity, and it is simple to make donations directly from our retirement accounts. I’ll assume your brokerage house offers the same check-writing privileges.

1. We each implemented check writing on an IRA account. Fidelity asks us to select the withholding amount they will send to the IRS when we write a check. Since all these checks would be for QCD, we picked 0%. We each have a book of checks.

2. We sell $5,000 of securities to make sure we have that in cash when the checks are cashed.

3. We decide on the charities and amounts. We decide which one (or both) will write QCD checks. We write and mail the checks. I’d like to use BillPay – store the name and address of each payee, cycle through and enter our donation amount, and have Fidelity mail the checks, but I can’t do that yet.

4. I need to keep the normal receipts for donations for my tax records. I need to make sure I tell my tax preparer our total QCD donations: Fidelity does not report that on the year-end 1099-R statements of distributions from IRAs.

== I can ask Fidelity to write and send the checks ==

If I have just a few donations, Fidelity will take the names and addresses over the phone and mail the checks. (That sounds too time consuming to me.) I can also use a QCD Withdrawal Form and have Fidelity write and mail the checks, but this is cumbersome. The form requires a Medallion Signature Guarantee that my bank does not provide; I would have to take the form to our local Fidelity investment center and have them provide that guarantee to itself.

Conclusion: You need check-writing privileges on your IRA account for donations you will make when you are over age 70½. You make donations from your IRA account to gain the full tax benefit of your donation. You no longer make charitable donations out of your checking account; if you do that, you are almost certainly throwing money away – paying taxes you do not need to pay.