Is Equal Weighting a means to easily beat the market?

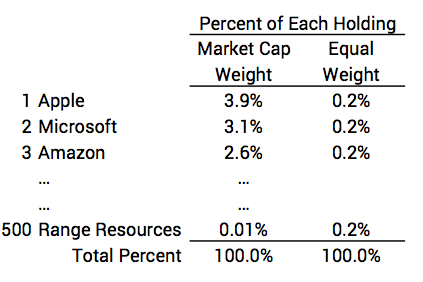

Well, this article says it’s a slam-dunk. Investment Strategies To Improve on Passive US Indexing states Equal Weighting is the way to go for retirees. The purpose of this post is to discuss the article and give you evidence from performance of several Equal Weight