Are you CELEBRATING the new high-water mark for your portfolio?

Posted on November 26, 2021

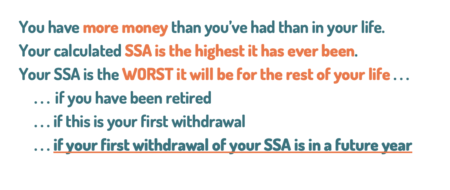

I set December 1 to November 30 is my “calculation year.” On the morning of December 1 I’ll calculate and find our Safe Spending Amount for 2022 (SSA; see Chapter 2, Nest Egg Care [NEC]). That will be a very good day. Patti and I will reach another high-water mark for our portfolio on our calculation date. I’ll calculate to another real increase in our SSA. ALL OF US should CELEBRATE, whether we have started our retirement plan or not. We are all at a high-water mark of portfolio value. Our SSA calculated now is the highest it’s ever been. It’s also the worst it will ever be for the rest of our lives; the math used to calculate our SSA uses the worst case assumption for future stock and bond returns; our SSA can’t get worse; it can only get better. The purpose of this post is to explain why ALL OF US – particularly for those who have not yet retired – should be ecstatic for the for SSA we calculate now.

== We’re retired: our new SSA ==

Next week Patti and I will take our eighth withdrawal from our nest egg for our SSA. It will be the sixth real increase in eight years. I’ll update this sheet in the post next Friday.

I withdrew 4.85% from our portfolio last December for our spending in 2021. I can see now that our real portfolio return – calculated for the 12-months ending November 30 – will be more than double that. I’ll have more in real spending power this December 1 than I had before my withdrawal last December 1. I have More-Than-Enough for our current SSA, and therefore our annual SSA moving forward has to increase in real terms (unless I decide to take out a lump of the More-Than-Enough to spend or gift).

When we’re retired, we’re always asking, “Was this year the start a Most Horrible sequence of returns?” The answer for this past 12 months is obviously “NO!” A Most Horrible sequence of returns cannot start in a year that you earn back more than you withdrew the prior year; you’ll always calculate to an SSA with greater spending power. The Most Horrible sequence of returns may start this December 1, but it clearly didn’t start last December 1.

== Your first SSA ==

If this year is the start of your plan and you are withdrawing for your first SSA, you should be happy as hell. You may think, “Wow, we’ve had three FANTASTIC years for stock returns. The SSA I calculate now is WAY BETTER than I thought it would be just last year. Is the market at a peak? Maybe I shouldn’t withdraw my calculated SSA, and I should pay myself – or ourselves – less that I calculate for 2022.”

Don’t do that! I think that is a natural concern given the returns these past three years. But we have no indication that the 12-month period beginning December 1 is the start of a Most Horrible sequence. Yes, inflation is higher than the last 30 years, but the economic conditions now are far better than at the start of Most Horrible sequences. We all may experiences a decline in real portfolio value next year or we may not, but it is WAY TOO EARLY to think about spending less than your SSA. We older folks only have a limited number of years left, and we should pay our full SSA to ourselves to ENJOY retirement when we are younger.

== Your first SSA, say, in a year from now ==

I owe my thinking here to my friend Jay, who is planning to start retirement in one or two years: that’s when he’ll take his first withdrawal for his SSA. Here’s the conclusion: if your first full withdrawal for retirement is in the future, you should calculate your SSA NOW as if you were withdrawing this December 1 for your spending in 2022. That SSA is the worst it will ever be – even if the market declines from now to when you actually take your first withdrawal, say, two years from now. This sounds flakey, but the logic is clear.

My friend Jay suggests a thought experiment. Patti and I visited the Einstein Museum in Bern Switzerland about six years ago. Einstein discovered his theory of special relativity by constructing a thought experiment. Jay is my new Einstein. Here’s the thought experiment:

Jay and Ray are identical twins. They look at their portfolios at the end of this November, and they have the exact same amount, $1 million; it’s their high-water mark. They have identical portfolios, holding the index funds, weights and mix recommended in Nest Egg Care. They both decide they want to take a full withdrawal for spending in 2022.

They email me and ask me to help them calculate their Safe Spending Amount to withdraw the first week of December for their spending in the upcoming year. They both are of good health, and they both agree that 19 years – through 2040 – for Zero Chance for depleting their portfolio makes sense. (See Chapters 2 and 3, NEC.)

I look up their Safe Spending Rate (SSR%) in NEC (See Appendix D) and find it’s 4.40%. I email back and say to both, “You can withdraw and totally spend/give $44,000 from your nest egg over the next 12 months. That’s in addition to your Social Security and other income. That $44,000 is the WORST it will ever be. It will at least adjust for inflation in future years. It’s unlikely that you are starting out on a Most Horrible sequence of returns, and chances are that you’ll calculate to real increases in your SSA over time. (See Chapter 9, NEC.)”

I don’t hear from them for a year. It’s December 1, 2022. Ray emails me, “Tom, help me. What can I withdraw now?” The 12-month period has not been good. Their real – inflation-adjusted – return on their portfolio return is -12% (mine, too!). That’s similar to 1969, the start of the actual Most Horrible sequence in history. Let’s assume inflation was 0%, just to make the explanation simple.

I email back to Ray. I think Jay must have the same question, so I email him, too. I give both the same answer, “You don’t calculate to a real increase in your SSA for spending in the upcoming year based on the poor returns this past year. You have no adjustment for inflation this year. You should withdraw the same $44,000 that you did last year and you can spend/give it all in the next 12 months. Yep, this was a bad year, and this could be the first year of the start of a Most Horrible sequence of returns, but we don’t know that. Remember your 19 years of Zero Chance of failing to be able to take a full $44,000 of today’s spending power is still intact.”

A few days later, Jay emails me, “Hi Tom, I failed to tell you: I actually changed my retirement date. I kept working at my parttime gig last year. I decided that I wouldn’t travel much. I lived off my Social Security and my other income. I did not withdraw anything from my portfolio last year, and I did not add to it.”

“I will take my first withdrawal for my spending now. You just told me I could withdraw $44,000. I talked to Ray and he tells me you said the same to him. I have $880,000 portfolio value; that has to be a bit more that Ray has because of his withdrawal last year. Do you agree that I can still take a withdrawal of $44,000?”

I tell Jay, “Yep, Jay, take the $44,000. You’re in the same basic boat as Ray. You both – actually all of us – may have ridden the first year of what may turn out to be a Most Horrible sequence of returns. That was the assumption that got you to your $44,000 SSA a year ago. You knew you could withdraw the $44,000 each year – adjusting for inflation – for your spending through 2040. In that worst case you’ll beat 19 years by a bit or you’re able to withdraw a shade more than Ray because you have a bit more in your portfolio than Ray does now. But let’s keep it simple, Jay: stick with $44,000.”

What I’m not going to do: I’m not going to apply a 4.40% SSR% (Jay’s one year older, but let’s assume that his SSR% did not change.) to a lower portfolio value than his high-water mark of $1,000,000. I’m not going to apply 4.40% to his current $880,000 portfolio and tell him he can only take $38,700 withdrawal for his SSA. That would be incorrect.

I’ll show exactly how this works – the detail calculations – in an upcoming post, but I think you have the basic logic if your first full withdrawal for spending is in a future year:

1. You can only ride the Most Horrible sequence of returns once. If you’ve had a down year or cumulative down years from your high-water mark – meaning you can’t calcuate to a greater, real SSA – you may be riding on the Most Horrible sequence of returns. But you never recalculate your SSA on the basis of lower portfolio value. It remains the same in real spending power. To recalculate would be applying the worst case assumption (your age appropriate SSR% that assumes you are starting anew on the Most Horrible sequence) on top of what already may be the Most Horrible sequence of returns.

2. The math of your plan really starts at your most recent high-water mark of your portfolio value. Assuming you use my November 30 calculation date in the future, you should calculate your SSA next week as if your first withdrawal is on December 1 this year. That’s your high-water mark, too, and the SSA you calculate NOW is the worst it will ever be for the rest of your life.

Conclusion: We all have reached a high-water mark for our portfolio value, and we all should CELEBRATE. Next week I’ll calculate to greater, real SSA than this year’s. Our new SSA is worst it will be for the rest of our lives; it will at least adjust for inflation in future years.

Someone who is starting their retirement plan now, withdrawing their first full SSA for spending in 2022, should similarly use their age-appropriate SSR% applied to their current high-water portfolio value. The SSA they calculate is the worst it will ever be; it will at least adjust for inflation.

Someone who thinks they will retire in, say, a year or two, has also really started the math of their plan now. They should calculate their SSA NOW– even though they won’t withdraw their SSA from their portfolio. The SSA they calculate is also the worst it can ever be; it will at least adjust for inflation in future years. That amount is the minimum they’d withdraw for their spending when they really start retirement.