What’s the story you tell yourself this time of year?

Posted on December 17, 2021

I typically use December 15 as a day I take a different look at our portfolio. I’ve described my imaginary “bottling day” in prior posts. Here’s one. I recast the performance of our portfolio into three holding periods or groups of wine barrels or buckets if you like those analogies. You can see my table here, but the purpose of this post is to state the story I want to tell my thinking brain about our financial retirement plan.

== Two things I learned this year ==

• I read the book, A Thousand Brains this year. (See this post.) I learned we fundamentally have two brains: a rational, thinking brain and an emotional, intuitive brain: this is similar to the concept in the book, Thinking, Fast and Slow. I learned that in times of stress my emotional, intuitive brain can easily overrule my rational, thinking brain. It’s going to kick in BIG TIME with fear and anxiety when something is wildly different from the usual pattern of life – it will go into panic mode when stocks nosedive, as an example. It will want to make decisions that are the exact opposite of what is appropriate.

I want to keep telling my thinking brain that I’ve made the right decisions that control the risk of outliving our money. I want my thinking brain to RULE and make the right decisions when times are tough.

• I also want to reinforce the new way I want to use bonds in the future. Bonds are insurance that I’ll use in difficult times. That’s a new model of behavior I want my thinking brain to follow. Here’s the story I’m telling myself this week.

== The right view of risk and I control it ==

I’ve got the right model of risk in my head. Risk is the uncertainty that Patti and I will outlive our money. Patti and I control that risk. 1) We will never spend a dime more than I calculate is a safe to withdraw our nest egg for our spending. 2) We invest to keep close to 100% of what the market will deliver in the future. 3) We have an action plan when things get rough.

My risk point is many years in the future. I have many years with No Chance of depleting our portfolio. My choice this year is to have 14 years of Zero Chance of depleting our portfolio. That choice determined the spending rate I just used for our 2020 spending. (Maybe it’s really 17 years from this recent post.) Fourteen years carries us to Patti’s age 88. I’d be 91. I see a hockey stick with shaft length representing the Zero Chance years. We’re locked in on 14 years.

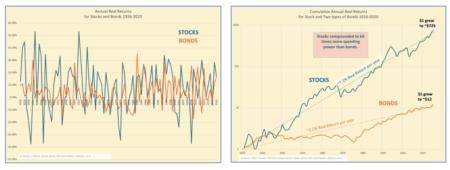

I DO NOT want my brain to think that risk is short-term variability of returns. The financial industry reinforces this view; they want to be paid to be the calming force when their clients’ emotional brain panics. Short-term dives in returns – the -35% dive for stocks in March of 2020 is an example – have nothing to do with our hockey stick and its shaft length. I want my thinking brain to look at the good graph that reinforces that it is a long game. I want it to reject the bad graph the financial industry likes to show.

== Many piles of money ==

I want my brain to see that Patti and I don’t have one pile of money. We have many. I want it to look at this loaf of bread: we eat one slice a year. Each has a different holding period: a holding period is the number of years we’ll hold on to an investment before we sell it for our spending. I just sold a ~5% slice two weeks ago. I’ll sell another slice the same time next December. I’ll sell another slice two years from now, and so on. I could view that I have 20 slices. My life expectancy is less than 11 years and Patti’s is 14. I conclude I’m being VERY prudent in the amount I spend per year.

== We’ve planned for the WORST CASE ==

I get to that low 5% spending rate, because we could be starting now on the Most Horrible sequence of stock and bond returns in history. We don’t have to invent a Most Horrible sequence of return. The worst in history is Most Horrible in my view.

That sequence starts with a six-year period of -45% real cumulative return for stocks, the worst in history. It also has a five-year period of -30% cumulative real return for bonds, the worst in history. Both are 0% cumulative return for at least 14 years. It’s almost statistically impossible to construct a sequence with those events. I’m convinced I’m using the WORST-CASE scenario for my planning. I’ve driven out market uncertainty. All of us will ride a better return sequence. An average or normal sequence of returns is MUCH BETTER.

== Investing cost is darn close to 0% ==

My decision on our investing cost is the second key to predicting how long our money will last in the face of the worst sequence of return. High-cost kills. I’ve driven our cost to lower than low with my choice of broad-based index funds. We keep 99% of what the market delivers before consideration of cost. We may pay 1/20th of what the average investors pays; those folks are giving up more than 15% of what they can safely spend or leave to their heirs.

== Bonds are insurance ==

My choice of mix of stocks and bonds is the third – and least impactful – decision that affects how long our money will last. I can actually lock in the number of years of Zero Chance of depleting our portfolio at any mix of stock and bonds by wiggling the spending rate.

Our mix of stocks really tells us how much more we will have when stock and bond returns aren’t Most Horrible. The mix of stocks that I picked for Patti and me has driven the high increase in our pay from our nest egg. We also have 25% more real spending power in our portfolio than we started with seven years ago.

Bonds are insurance. I have three years of bond insurance. When stocks fall off a cliff, I’ll sell bonds, not stocks, for our spending. I’m buying time for stocks time to recover. I plan on using my insurance in a one-in-ten-year event of Very Bad stock returns – -12% real return or worse. It’s very rare that I would have to tap all three of insurance payments during retirement. The chances are, though, that I will at least see one Very Bad year.

== Happiness is 46% real increase in pay ==

Our pay from our nest egg can only get better. l always calculate to a real increase in pay when Patti and I earn back more than we’ve withdrawn for our spending. We earned back more than we withdrew in five of the last seven years. We have +46% greater pay for 2022 than for 2015, the first year of our plan. (Every retiree following Nest Egg Care has calculated to +15% real increase in pay over the last two years.)

Future returns may not be as good as they have been over the past decade or so. Stock returns have been well above average since 2009. Since we’re withdrawing each year for our spending, we’re always putting stress on our portfolio. Patti and I are older. We withdraw more. We stress our portfolio more than younger folks. We may never earn back enough to calculate to another real increase in spending. Our portfolio value may decline. But that does not mean we’ll ever have to lower our current pay. We won’t be unhappy if it never increases for the rest of our lives.

Conclusion: Every December 15 I recast the performance of our portfolio arranged in three broad holding periods. I did this on the 15th, but I decided this week to write down the things I wanted to reinforce in my thinking brain. When times get rough – stocks fall off a cliff – my emotional brain could take over and make dumb decisions. I want to my thinking brain to RULE when times get rough. I want it to understand that Patti and I have a solid financial retirement plan.