What’s in the inflation report to cause the market to JUMP?

Posted on November 11, 2022

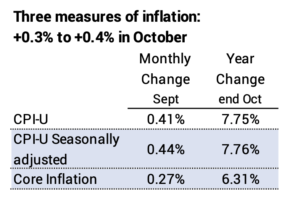

New data on inflation came out yesterday, and US stocks jumped +5.7%. WOW! That’s the third month with big changes on the day of the monthly report on inflation. The jump for stocks in October was +2.5% and the dive was -4.5% in September. This post displays the trends in inflation data: 1) Monthly seasonally-adjusted inflation was +0.4%, the same increase as last month. 2) Core inflation – inflation less the volatile energy and food components – was +0.3%, half that of the prior two months and the lowest in the past year. I suspect this latter measure of inflation gave a spark to the stock and bond markets.

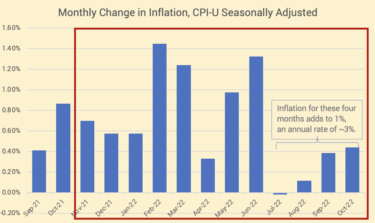

I show the monthly changes for inflation in the next two graphs. Each month replaces the same month from a year ago. Next month, inflation for November, will replace November from a year ago. We hope each future month is low inflation and lower than the month it replaces: the 12-month record of inflation will continue to decline.

== Seasonally adjusted CPI: +0.44% for October ==

Seasonally adjusted inflation was 0.44%. This was about the same as September. Those two average to annual rate of about 5% inflation. That’s high relative to the Fed’s target of 2%, but inflation over the last four months has been 1%; that’s an annual rate of about 3%. This month’s change was half that of October of 2021. Therefore, the rate for the last 12 months fell to 7.8%.

== Core Inflation: +0.27% for October ==

Core inflation was 0.27%, half that of the last two months. 0.27% is the lowest monthly increase in the past year. The 0.3% this month was half that of October 2021. Therefore, the rate for the last 12 months fell to 6.3%. Core inflation has been lower than the other measures since the two excluded items increased much faster: food prices increased 11% and energy prices increased 18% over the last year.

The 7.8% 12-month inflation (CPI-U; not seasonally adjusted) is trending down from its peak of 9.1% in June:

== Some components of inflation ==

I don’t see the effects of inflation in our spending. I track our total monthly spending from our checking account, and I don’t see our total spending increasing that fast. But inflation is affecting us when when I look at a number of components of inflation shown here. Some of these increases are staggering: airfares + 42%! Patti and I will see big increases in our gas bill for heating this winter.

Conclusion: The stock and bond markets jumped yesterday on the latest inflation report. I think the key measure was Core Inflation: total inflation less the volatile components of food and energy. The monthly increase was half that of the last two months and is the lowest in a year. I suspect that news was the reason for the big jump in stocks and bonds.