What segments of US stocks outperformed in 2021?

Posted on January 21, 2022

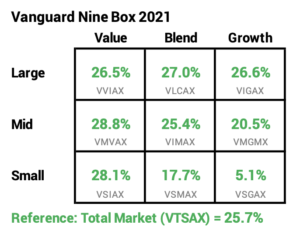

I like looking at Vanguard’s Style Box (I call it a Nine Box.) at the end of the year to get a snapshot of what outperformed and what underperformed the US stock market as a whole. This post shows 2021 results. It was obviously a good yea with US Total Stock +25.7%. Large-Cap led Mid- and Small-Cap stocks. Large Cap Value nearly matched Large Cap Growth, unlike recent years when Growth stomped Value. Small-Cap Growth was the clear laggard.

I’ve displayed the Nine Box before: for 2017, 2018, 2019 and 2020. This is the first year I’ve been able to show the returns over the past ten years: Large Cap Growth has been the clear winner over five and ten years; US Total Stock Market beat six of the nine boxes.

== 2021 Total US Stocks = +25.7% ==

I use the Vanguard index fund that focuses on each of the nine segments. Their returns are very close to the index they are trying to meet. I display returns for all the boxes, and I display the 25.7% return for VTSAX – the Vanguard index fund that holds ~4,100 all traded US stocks. (Patti and I hold the Total US Stock fund FSKAX, also +25.7% in 2021; the two differ by a few 1/100ths percentage points each year; over time the two should be identical.)

The columns in the Nine Box are Value, Blend, and Growth stocks and rows are Large-Capitalization (Cap), Mid-Cap, and Small-Cap stocks. The nine boxes aren’t equal in market value of the stocks they hold. Large-Cap represents about 80% of the total value of all US stocks.

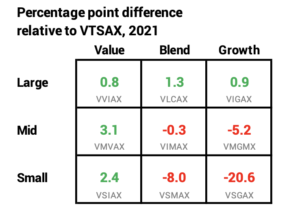

== 2021 Returns relative to VTSAX ==

I show the percentage point difference for 2021 in each box relative to VTSAX – the Total US Market fund.

Large-Cap stocks were better than VTSAX. Mid-Cap and Small-Cap stocks on average did not match VTSAX.

Mid-Cap Value and Small-Cap Value were winners in 2021. Small-Cap growth was by far the laggard – by more than 20 percentage points.

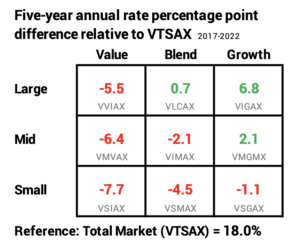

== Five years: Large-Cap Growth. Not Value or Small. ==

Over the past five years, Growth leads Value for the three capitalizations. The biggest difference is in Large Cap: Large Cap Growth has averaged about 12 percentage points per year better in return than Large Cap Value. That five-year difference compounds about 67% more from VIGAX than VVIAX. Value has clearly has lagged. Small-Cap has lagged. Total US Stocks (VTSAX) handily beat five of the nine boxes.

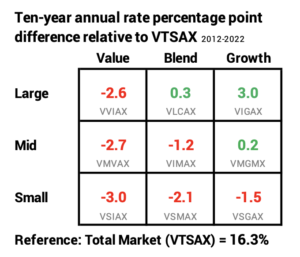

== Ten years: Large Cap Growth ==

Over the last ten years, Large-Cap Growth was the place to be. Value and Small were not the places to be. Again, US Total Stocks looks pretty darn good. It outperformed six of the nine boxes, and it was close to two others.

== 2021 World stocks = 18.84% =

For reference: the total world market stock index, MSCI All Cap World Index = 18.84% for 2021. US stocks are roughly 55% of the total value of all stocks in the world. Total International Stocks (VTIAX) = 8.62% in 2021. (Patti and I own the ETF of this = VXUS = 9.00%.)

Conclusion: 2021 was another terrific year for US stocks, the third in a row. Total US stocks returned 26%. That follows 21% in 2020 and 31% in 2019. Wow!

Every year some segments of the market outperform and some to underperform. This year Large Cap stocks outperformed Mid- and Small-Cap stocks. All growth stocks outperformed value stocks of similar capitalization. Large-Cap is about 80% of the total value of all stocks, and Large Cap Growth and Large Cap value were almost identical in return this year. Large-Cap Growth has outperformed over five and ten years. Total US Stocks has outperformed six of nine boxes.