How much downside protection have value stocks delivered year to date?

Posted on June 5, 2020

Value stocks – departing from conventional wisdom – provided ZERO relative downside protection in this recent decline. The conventional wisdom is that value stocks with lower price-to-earnings ratios and higher dividend yield are safer to own when the market hits a rough patch: they will decline less the market as a whole. This post looks at the performance of different styles of stocks since the first of the year. Value stocks declined MUCH MORE – about 9 percentage points more – than the market as a whole and performed much worse than growth stocks. It’s really hard to figure out what segment of the market will outperform. I conclude you should stick with a broad-based, total stock market fund.

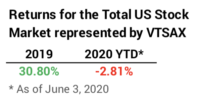

I’m sure we are all surprised at the year to date (YTD) return of about -2.8% for US stocks given that nearly 40 million are now unemployed. Last year’s return was +30.8%. This decline now looks like a small correction. Of course, we’ll just have to see how this unfolds over the next year or so.

== Style box ==

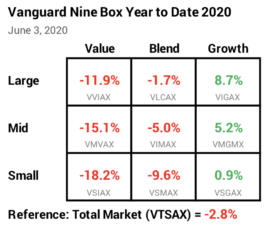

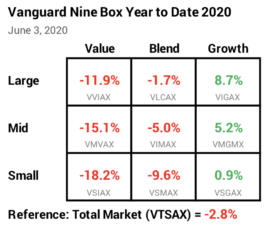

Morningstar popularized the style box shown below. The style box divides the total stock market into a matrix of Large, Mid and Small Capitalization stocks and by Value, Blend, and Growth stocks. Vanguard has a low cost, passively managed fund that tries to match an independently assembled index for each box by The Center for Research in Security Prices (CRSP). I show the Vanguard fund for each box and its YTD performance.

You can see that Value stocks have been the big loser YTD. Growth stocks, thought to be more volatile during a market decline, have been the winner. Large Cap has been better than Mid Cap, and Mid Cap has been better than Small Cap. Looking at two corners shows Large Growth has been ~27 percentage points better in return than Small Cap Value [8.7% – (-18.2%)]. Wow.

== Performance Relative to the Market ==

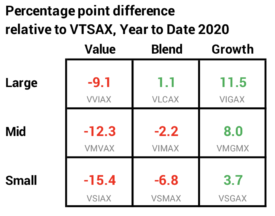

I use VTSAX (or FSKAX which we own) as the benchmark for the US stock market. In the matrix below, you can more clearly see the boxes that are better than the market as a whole and ones that are worse. VTSAX and similar US Total Stock Market index funds and ETFs own almost all traded securities in the US. The fund owns a percentage of each company in proportion to its market value to the total market value of all stocks. The market value of Microsoft (total shares times price/share) is about 4.8% of the total value of all stocks, so these funds own 4.8% of Microsoft.

Most of us are going to own much more of Large Cap stocks than Mid Cap or Small Cap stock, because Large Cap stocks are roughly 75% of the total value of all stocks. In this display, you can see that Large Growth is 11.5 percentage points better in return than VTSAX and the Large Value is 9.1 percentage points worse. That’s a +20 percentage point difference in return [8.7% – (-11.9%)]. If you bet on Large Growth, you are very happy. If you bet on Large Value, you are unhappy.

I prefer not to bet to tilt or overweight to one or several of those boxes in the matrix. A US Total Market Stock fund or ETF isn’t trying to pick the box that will be better than others over time. I could look over the past few years and ask, “Why didn’t I own more growth stocks? I’d have more than from my neutral, Total Stock Market fund.” But I could have just as easily decided to bet on value stocks and had less. Or more Mid Cap. Or more Small Cap.

I’ll always be able to look in hindsight and find I could have done better had I tilted our portfolio to own more of one or several style boxes. But I won’t second guess. Patti and I are doing just fine with our total US market stocks.

Conclusion: Most investors – and I’d bet even more retired investors – think Value stocks will offer greater downside protection when the stock market hits a rough patch. That certainly has not panned out in the decline for US stocks so far this year. Year to date, Large Cap Value stocks declined about nine percentage points more – about three times more – than the market as a whole. It’s impossible to predict which style of stocks – grouped by capitalization value or by type of stocks – will outperform in the future. I’ll stick with my broad-based US stock market fund.