How do we stack up against private equity and hedge funds?

Posted on January 30, 2026

Years ago I contributed to a CMU (Carnegie Mellon University) fund to honor John R. Thorne. I received a short report on the performance of that fund this week. I quickly calculated 10% return the last year. That led me to the annual report on CMU’s total endowment fund. It’s similar to most university endowments: they have the goal to beat the heck out of public stocks and bonds. They invest in things that we individuals can’t invest in. Publicly traded stocks and bonds are only about 35% of the total. Private equity is 45%. Hedge funds are another 12%.

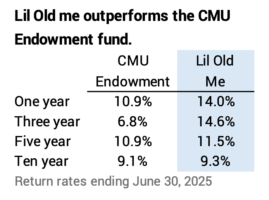

Are they killing it? NO. Lil old me with four index funds has done better. You’ve done better if you follow the recommendations in Nest Egg Care. We’re not missing out on far better investment opportunities only available to the big guys.

Details:

Here’s the endowment’s investment mix: that looks COMPLICATED!

Here’s the performance comparison: I win for all periods displayed.

The endowment’s mix is 85% equity and 15% fixed income; I used 80% and 20% in my calculation. Had I used 85%-15% (my current mix), my returns would be about ½ percentage point better per year.

====

I scan this report that reports on the performance of more than 650 university endowments for the fiscal year ending June 30, 2024. I think the CMU endowment performs better than average. Private equity and hedge funds do not look like paths to riches.

CMU’s Chief Investment Officer is the second highest paid employee the University: $1.5 million in 2024!

Conclusion. We individual investors can’t invest like the big boys can. We can’t invest in private equity or hedge funds to get superior returns. A class of big boys, university endowments invest far more in private equity + hedge funds than publicly traded securities in their effort to dramatically outperform. I show in this post that at least one does not outperform us little guys who hold just a few broad-based stock and bond index funds.