Do you need to pull out the reminders as to why you shouldn’t worry?

Posted on February 28, 2020

This is a scary week. Does the rapid decline in the stock market worry you? I’m more worried about the coronavirus. Patti and I are in the age bracket most susceptible to viruses: our immune system to kill a virus just isn’t as strong as it was when we were younger. I’m much less worried about our financial future, largely because our financial retirement plan has anticipated scary times like this. I have reminders planted in my head to calm any worries. The purpose of this post is to list the things I’m telling myself this week. If you’ve followed the plan in Nest Egg Care, you should have an almost identical list.

== Spend and Invest is harder than Save and Invest ==

Patti and I are in the Spend and Invest phase of life. We annually need to sell securities for our spending. That means we’re more affected by bad variability in stock and bond returns. We’re hurt most when we sell when stocks and bond have declined.

Those of you who are not retired are in the Save and Invest phase of life. That’s easier in times like this: just keep adding your routine monthly contributions to your retirement account. You’re gaining the advantage of dollar-cost averaging. This nosedive in stocks is helping you. It’s not hurting you.

== My checklist ==

Here’s the checklist I go down in periods like this.

We’ve planned for the worst. The basic concept of Nest Egg Care (NEC) is to plan for the worst and adjust when you find you are not on the track of the worst. The worst is the most horrible sequence of stock and bond returns in history. That’s what drives our Safe Spending Rate (SSR%) and our Safe Spending Amount (SSA) to a low, low level. (See Chapter 2, NEC.)

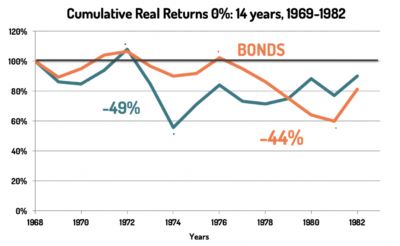

We’re far away from the worst. Our plan assumes we will ride the most horrible sequence of return in history. The most horrible sequence of return I find had cumulative real returns for stock and bonds of below 0% for 14 years. That included a two-year period when stocks declined in real spending power by -49% and a five-year period when bonds declined by -44%. Statistically that steep of stock decline is a 1-in-185-year event and that bond decline is a 1-in-2400-year event. I don’t know how to calculate the chance of both of those events occurring in the same 14-year period, but I think the chance is far lower than 1-in-2400.

Our first real worry-point is when Patti is 87 and I am 90. That’s 15 years in the future for us. We have zero chance of depleting our portfolio through the end of 2034 when Patti would be 87 and I would be 91. I keep the image of our hockey stick in mind. The shaft length is the number of years of no chance of depleting our portfolio. We’re locked in on that inflection point 15 years from now. We do have increasing chances of depleting our portfolio after that inflection point, but, unfortunately, it’s low probability that we both won’t be alive then.

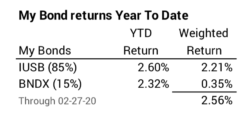

Bonds are insurance, and our insurance is not declining. We all hold bonds as insurance when stocks crater. We’ll sell bonds – disproportionately more than stocks or even 100% – when stocks dive. All of us have more insurance now that we had at the start of the year because bonds are in positive territory. I can see on my phone that stocks are down about another 1% so far today, and bonds are up about .5%.

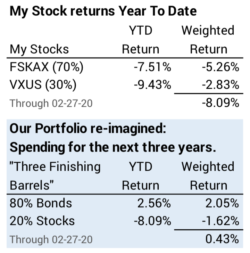

• It helps to re-imagine our portfolio mix for what we’ll spend in the next few years. Every December I re-imagine our portfolio into three holding periods: Short (three years), Mid (four to ten years) and Long (more than ten years). If I re-imagined as of last night, I’d see that our near term portfolio is in positive territory year to date.

I don’t need to sell ANY stocks for our spending until July 2023 – more than three years from now. And I can push that to 2024, almost four years from now.

1. All our spending for 2020 is in money market and CDs that mature this year. I sold securities for our total 2020 spending in the first week of December 2019.

2. My scheduled sale of securities for cash we’ll need for spending in 2021 is nine months away – the first week of December 2020, but I don’t need to sell stocks or bond in my Investment Portfolio then. If I push, I can get to early 2024 before I have to sell stocks.

• I have roughly two years of spending in Reserve. (See Chapter 7 NEC and The Patti and Tom File at the end of Part 2.) Your Reserve is an off-the-top amount. It’s not part of your Investment Portfolio that you use to get your SSA. Our Reserve is invested in IUSB. I can use that Reserve – and not sell from our Investment Portfolio – if returns are really bad over the 12 months ending this coming November 30. I can totally skip selling from our Investment Portfolio in early December 2020 and again in December 2021. Our Reserve can carry us to the next sell point in December 2022.

• I can lower spending over the next two+ years. That would be easy for us. Our SSA is 22% higher in real spending power than it was when we started five years ago. It would be easy for us to cut back to our 2015 spending level. Lower spending would buy me about another six months delay in the time I have to sell in our Investment Portfolio. I can slide December 2022 to about July 2023.

• Finally, I can still sell a disproportionately high percentage of bonds in our Investment Portfolio. If I did that, I would further slide the first required sale of stocks for our spending into 2024. Almost four years from now.

• I also have over $100,000 unused Home Equity Line of Credit: now I’d really be pushing it!

Conclusion: Times like this are nerve-racking. But if you’ve followed Nest Egg Care, you should be confident that you’ll never get close to the worst event – depleting your portfolio such that you are not able to take a full withdrawal for your spending in the upcoming year. Short-term bad variability is not the concern. We retirees are hurt most when we’re forced to sell stocks in several years when they’ve decline by a least 30%.