Did you calculate to at least 6% real increase in your Safe Spending Amount for 2026?

Posted on November 30, 2025

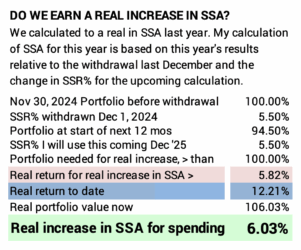

I use the 12 months ending November 30 to calculate our Safe Spending Amount for the upcoming year (SSA, Chapter 2, Nest Egg Care [NEC]): that’s what we can safely sell from our portfolio for our spending and know that we will not outlive our portfolio. Our real portfolio return for the year was 12.2%. That works out to be 6.0% real increase for our SSA. If your portfolio is similar to ours and you are younger, you would calculate to a greater increase: you would have withdrawn a smaller percentage last year.

Details:

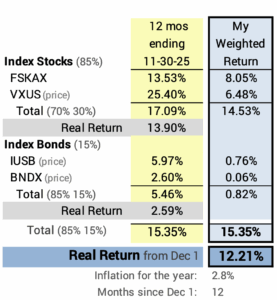

== 12.2% real portfolio return ==

Stocks returned about twice their long-run average of 7.1% real return. Bonds were slightly above their long-run average of 2.3%. Our 12.2% real portfolio return led to our 6.0% real increase in SSA. You can also see this display on this sheet.

== History of 11 years ==

My historical spreadsheet assumes that Patti and I withdrew our full SSA each year. That spreadsheet has a dizzying amount of detail. Here are highlights.

1. Our real portfolio returns have ranged from -18.4% (2022) to 22.1% (2024). The average is 7.8% annual return. That’s above the long-run or expected 6.4% real return for our portfolio for our mix of 85% stocks and 15% bonds.

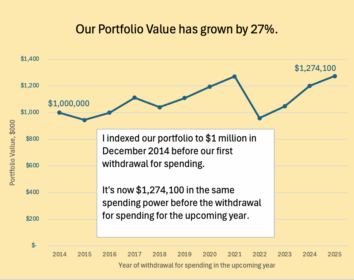

2. Our investment portfolio increased in real spending power despite annual withdrawals for our spending. I indexed our investment portfolio to $1 million in December 2014 before my first $44,000 sales of securities for spending in 2015. Measured in the same spending power, our portfolio now is $1.27 million before I sell securities for our spending for 2026. The spreadsheet assumes we’ve withdrawn $545,800 for our spending from our investment portfolio; we used our Reserve for our spending in 2023.

3. The increases in portfolio value have fueled increases in our SSA. Our SSA – sales of securities for our spending – increased from $44,000 in December 2014 to $70,000 now. That’s a 59% increase in real spending.

Conclusion: I calculate our Safe Spending Amount (SSA) for the upcoming year based on our 12-month returns ending November 30. Our real portfolio return was 12.2%. That’s nearly twice the expected return rate on our portfolio of 6.4%. I calculate 6.1% real increase for our SSA. Those younger with a similar mix of stocks and bonds will calculate to a greater increase: they withdrew a smaller percentage for their SSA last year.

Our investment portfolio is +27% more in real spending power than we had in December 2014 despite withdrawals that have been more than half of the amount we started with.