When should you take your RMD during the year?

Posted on August 26, 2022

My friend Jay sent me a clip from his Kiplinger letter that suggests you take your RMD early in the year. This is not a correct strategy. This post argues that your should take your RMD, if you can, all at the end of the year. You want to gain a year’s worth of tax-free growth and you gain the ability to avoid withholding taxes for the IRS for most all the year: you get a tax-free loan from the IRS. Both actions are to your advantage.

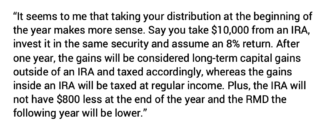

Here’s the clip, an excerpt of a letter to the editor:

This sounds like a good idea, but it’s better to take your RMD, if you can, at the end of the year.

== In the Save and Invest phase ==

When you were in the Save and Invest phase of live, which was better: to contribute to your IRA at the beginning of the year or at the end of the year? It was – is – always better to contribute at the beginning of the year rather than the end of the year or right before April 15 — you can contribute up to that date for the prior tax year.

Why? You gain a year of tax-free growth, and that’s the big advantage of retirement accounts. It’s clear that you’d prefer to contribute to a Roth IRA at the first of the year. If you waited to the end of the year, you’d pay tax on dividends during the year. Those are taxes that you would never had to pay in your life if you contributed at the start of the year. Also, you’d want to keep any gain from price appreciation during the year in your Roth, since you’ll never pay tax on that gain in the future.

The same logic holds for a traditional IRA, although it’s pretty easy to get twisted. You have to stick with the logic that tells you a traditional IRA and Roth IRA give you the exact same after-tax benefit – assuming the same tax bracket at the time of contribution and withdrawal. Therefore, the much-easier-to-understand logic that applies to a Roth IRA applies to a traditional IRA. You want to contribute to your traditional IRA at the first of the year to gain the similar benefits of tax free growth; you don’t want to contribute at the end of the year.

== In the Spend and Invest phase ==

You want to do the opposite now that you are in the Spend and Invest phase. You want to hold on to tax-free growth for the year. You don’t want to stop tax-free growth any earlier than you have to. If you withdraw from your Roth early in the year, you’ll pay tax on the subsequent dividends; you’ll pay tax on the subsequent price appreciation when you sell to get cash for your spending. You don’t want to do that. Wait as long as you can in the year to withdraw from your Roth. The same logic again applies to your traditional IRA.

== A tax free loan from the IRS ==

When you take all your RMD at the end of the year and withhold all taxes due then, you have delayed paying the IRS taxes that you must withhold. You’ve gotten an interest-free loan from the IRS for taxes that you otherwise would almost certainly pay earlier in the year.

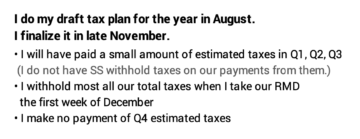

For example, I pay very little estimated taxes for the first three quarters of 2022. I withhold almost all the taxes I estimate Patti and I will pay in 2022 when I sell securities this December for our RMD and transfer the net to our taxable account. In essence, I’ve gotten a tax-free loan from the IRS by delaying when I actually pay our taxes. The IRS sees that I withheld almost all of taxes due for the year, and assumes I withheld those taxes throughout the year; it doesn’t fit the dates of when I withheld taxes in the schedule to see if I might owe a penalty for quarterly underpayments. I suffer no penalties from paying almost all of our taxes due in December.

== The final nail in the coffin ==

I made the argument similar to the letter to the editor in this post, but I was mistaken. I took a portion of my RMD this May by transferring shares of FSKAX to my taxable account. I explain the reason in that post. It wasn’t to avoid or pay less taxes, but I did think that I would come out ahead on taxes. It won’t work out that way: I’ll pay greater tax this year (and less tax later).

This gets a little hairy.

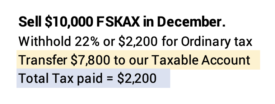

Option 1. I wait until December to take my RMD. Let’s assume that is $10,000. I sell 100 shares of FSKAX in my IRA at $100 per share. Let’s assume this price/share at the start of the year is the same it will be at the end of the year. Let’s assume Patti and I are in the 22% marginal tax bracket. I withhold $2,200 for my 2022 taxes when I execute the transfer to my taxable account. My net transfer to our taxable account for our spending is $7,800.

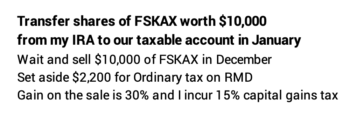

Option 2. I transfer 100 shares of FSKAX in January at the start of the year, also at $100 per share. (My transferring of shares would be the same as selling shares in my IRA; transferring the cash with no withholding; and buying the exact same security on the same day.) I owe $2,200 for my 2022 taxes for this withdrawal-transfer, but let’s assume I did not sell $2,200 of FSKAX in my IRA for taxes to be withheld.

My 100 shares of FSKAX are combined with my greater amount of shares of FSKAX in our taxable account. Fidelity records my 100 shares as short-term shares and, with the exception of a relatively few shares that were distributed in the month before in December, all other shares are long-term shares. Fidelity also displays my average cost for my mutual fund shares. The average cost of my FSKAX was something like $68 per share before I transferred the 100 shares, and I now see it is $70 per share; my shares at $100/share are combined with many more shares acquired at a much lower average cost.

It’s now December, and I sell $10,000 of FSKAX. I have $10,000 cash proceeds, and I’ll set aside $2,200 for the tax ordinary taxes I will owe. I’ll pay that in a Q4 estimated tax payment in January.

But I now also incur tax on the sale of the 100 shares and need to set aside those taxes, too. Fidelity (and your broker) records sales of mutual fund shares at average price and on a first-in-first-out basis. At my average price of of $70 per share, I have gain of $30 per share. All shares sold are judged to be long term – my oldest or “first in” shares are all long-term shares.

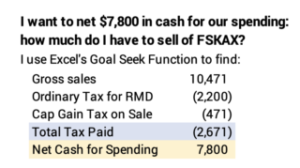

I now have a $3,000 long-term capital gain on my sale and will owe $450 (15% in tax) that I must also include in my Q4 estimated taxes. I don’t have $7,800 net for our spending, I have $7,350, and I need to sell more securities to get that $450 and I’ll incur a bit of tax on that, so I have to sell more than $450 of securities. I actually have to sell $471 more of FSKAX, and I’ll pay a total of $2,671 in tax.

Conclusion: When you are retired, with rare exception, you always want to take your RMD at the end of the year if you can. In the year I started our retirement plan, I sold from our taxable account for our spending in the calendar year. I delayed taking my RMD to December (Patti was not subject to RMD at the time): that wound up being the cash we needed for our spending in the upcoming calendar year. By delaying your RMD to the end of the year, you are gaining another increment of tax-free growth, which is always to your advantage. By delaying your RMD, you have an ability to delay paying income taxes for the year, meaning you’re getting an interest-free loan from the IRS.

“If you withdraw from your Roth early in the year, you’ll pay tax on the subsequent dividends; you’ll pay tax on the subsequent price appreciation when you sell to get cash for your spending. You don’t want to that. Wait as long as you can in the year to withdraw from your Roth.” — Aren’t ROTH IRA withdrawals 100% exempt from taxes?

Yes. Roth withdrawals are 100% exempt from tax. But as soon as you withdraw, you are stopping the clock on tax-free growth (the 100% tax exemption). All future dividends will be taxed. All future price appreciation will be taxed. As a general rule, you therefore want to withdraw late in the year: keep the clock running on tax-free growth as long as you can.

Tom