What percent of the market is Index funds?

Posted on April 14, 2023

The report “Shooting the Messenger” that I mentioned in this blog states that 25% to 35% of the total value of all stocks is held by Index investors. I was not able to follow the math. In this post, I cite a different data source and conclude that Index funds are about 15% of the value of all traded US stocks.

== ICI Factbook ==

The Investment Company Institute (ICI) issues an annual Factbook. ICI is a trade association of US registered funds. That’s almost solely mutual funds and ETFs.

ICI gathers data on total year-end assets and the detail of 350 US stock Index funds and ETFs and 3,000 Actively managed stock mutual funds. It captures the data for 98% of the industry’s assets.

== Display: 16% ==

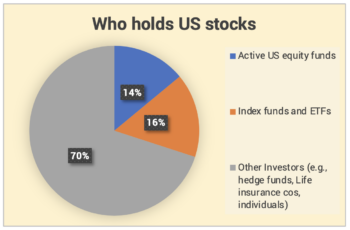

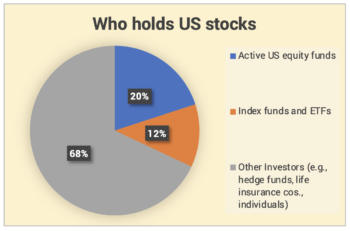

ICI displays of the total ownership of US stocks. It shows Index funds at the end of 2021 owned 16% of the total. A pie chart looks like this. Index > Active.

== Other data calculates to 12% ==

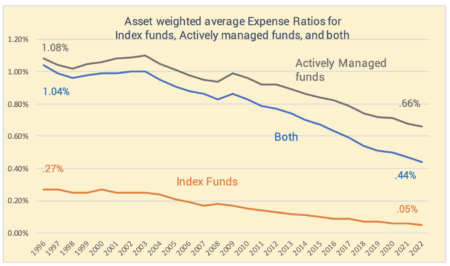

Other data I get from the ICI report calculates to 12%. The Factbook calculates the weighted-average expense ratio for both Active funds, Index funds, and the two. This is similar to a graph in the Factbook:

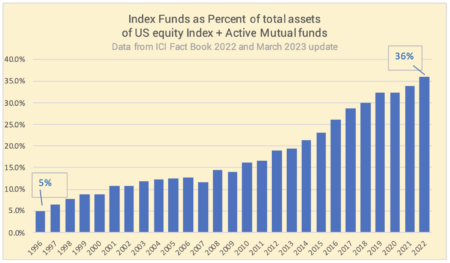

Armed with this data, one has to use a bit of algebra to calculate the percentage of each that results in the overall weighted average expense ratio. I plot the result that shows the steady growth of Index funds. At the end of 2022 (supplemental data here) Index funds are 36% of the total of Index funds + Active funds. Active > Index.

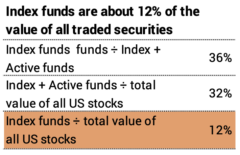

The ICI Factsheet – the first page in the Factbook – states the registered Index funds + Actively traded mutual funds hold 32% of the total equity value of all US Stocks. (Not 30% shown on that first display.) Using the multiplication, Index funds are 12% of the total value of all US stocks.

The pie chart looks like this. Active > Index.

Is this accurate? Are some of the other investors Index investors? No, I assert no portion of other investors are Index investors. I’d argue that big, institutional investors are going to invest in Index funds if they choose to mirror the market. They’re not going to try to build their own portfolio – build their own index fund in effect – to track an index. The operating costs of Index funds and tracking accuracy can’t be beat. A broad-based stock fund that precisely mirrors the S&P 500 or total market costs as little as 0.015% of assets invested: that’s effectively 0.015% reduction of an expected 7.1% real return rate for stocks: investors in those Index funds keep 99.8% of market returns.

Conclusion: I’ve read different estimates or calculations of the percentage of total US stocks held by Index funds. I think the best data source is the Investment Company Institute’s annual Factbook. I find and calculate two different percentages, but I conclude about 15% of all US stocks are held by Index funds.