If you have a Variable Annuity, should you keep it or sell it?

Posted on July 31, 2020

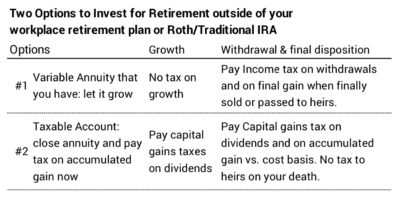

Have you invested in a variable annuity? Last week I wrote that I would not invest in one as an option to help build a retirement nest egg. This case is different. It assumes you already have a variable annuity. What should you do? 1) Keep it and let it grow tax deferred; pay income taxes on your withdrawals for spending; or 2) Sell it and put the net proceeds in your taxable account; pay on-going capital gains taxes on dividends and then on accumulated gains on your withdrawals for spending? This post examines those two options.

My basic conclusion: the two options result in little difference in the net you will have to spend in your lifetime. But, depending on how much you withdraw during your life time for your spending, your final beneficiaries will get more if you sell and let the net proceeds grow in your taxable account.

== The plain vanilla version ==

I am comparing two options for a plain vanilla version of a variable annuity in this post. In this post I’ll assume you hold the exact same fund – or its mirror image – and that the variable annuity adds .35% annual cost to the alternative of holding a mutual fund in your taxable account. This is the same cost difference I displayed last week.

You always have the option of converting the value of your variable annuity to a fixed stream of payments – an annuity. You incur a cost for the guarantees the annuity offers, and you can add other features that increase the cost even more. Some of those features can add BIG costs, but I won’t explore whether the benefits you get for the features are worth those added costs.

Patti and I pay less than .05% cost on our portfolio value that drives our annual Safe Spending Amount (see Chapter 2, Nest Egg Care). You’ll be close to that following the recommendations in NEC. I’d look VERY HARD at what I’d get for costs greater than that.

== The starting point is different ==

The starting point differs from last-week’s comparison. Last week we started out with an amount to invest and looked at the choice of holding the same fund – or its mirror-image fund – in a variable annuity account or in a taxable account. A variable annuity loses out, primarily because of its greater annual costs. You want to keep your money in your taxable account.

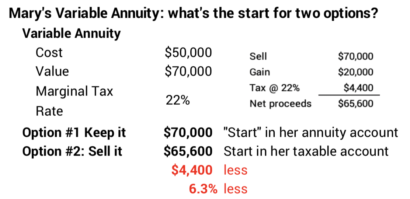

For this comparison, you have less to start with in your taxable account. You have less because you first have to close out your variable annuity account and pay tax on the gain you’ve accumulated. This is roughly how the two options look for my friend, Mary, who has a variable annuity. If she closes out her variable annuity account now she’d have about 6% percent less to start out with in her taxable account.

I’ll use Mary’s example in this post. Mary and her husband (now deceased) bought the annuity and the security recommended by their financial advisor many years ago. Mary’s gain is not that high relative to the length of time she’s held it, because that was the first source of cash her advisor tapped when she asked for more to spend than she would have from her RMD. I have no idea why this was the first source of added cash, because it was not her lowest tax-cost source of cash:

When you withdraw from a variable annuity, you are first paying income tax on the gain portion – the next $20,000 of withdrawals in Mary’s case. That’s different than the way taxable income is calculated on your taxable securities: you pay tax on sales proceeds for the shares sold less your cost of those shares. That math results in far lower taxable income, possibly a lower tax rate, and therefore lower overall tax cost.

Mary’s in the 22% marginal tax bracket before considering any withdrawals from her variable annuity. That’s primarily from her Social Security, her monthly payments as the survivor of her husband’s defined benefit pension, and her RMD.

Let’s roll with Mary as the example and her 22% marginal tax rate for her withdrawals from her variable annuity. Your case most likely will be different, but I think the final conclusions will be the same.

• Greater added cost for the annuity favors selling it and investing the net in your taxable account. My assumption of .35% greater cost is low.

• You may be in the 12% marginal tax bracket; this will favor keeping the variable annuity.

== Same dollars to you, but more for your heirs ==

I display the summary I show on this detail for Mary. I calculated the net proceeds after paying all taxes that she’d have for spending in ten years. The difference in the two is within 1%. She comes out essentially the same. There is no compelling case to keep or sell the variable annuity.

It is compelling to sell and keep the net proceeds in a taxable account when one looks at the final end point after you or your surviving spouse have died and the beneficiaries are your children. On Mary’s death her children will pay income tax on the gain in her variable annuity, and I assume her children will be in the 22% marginal tax bracket then. Alternatively they pay no taxes on the value of her securities in her taxable account at her death. They get a step up in value that becomes their cost basis for the shares they inherit. They get 9% more in this example.

== What to do if you decide to sell ==

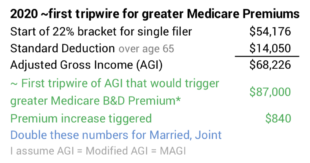

You’d prefer to sell when your variable annuity account on dips in value. That means your taxable gain will be low. You’ll pay less tax. A greater percent of the total goes into your taxable account. Less tax also means less chance of crossing a tripwire of income that would trigger greater Medicare Premiums.

The best time for Mary to have sold was when the market declined in March. The market declined by roughly a third. Mary’s account value may have declined from $70,000 to $50,000 – close to her $50,000 cost. If she sold then, she would have had no taxable income and incurred no tax. She would have started her taxable account without the current six percent penalty. (Too bad that I had not thought this through to tell her.)

Conclusion: If you have a variable annuity account, you likely have no compelling reason to keep it or to sell it and keep the net proceeds in your taxable account: you’ll have just about the same net to spend in retirement. But if you want to leave more to your heirs, the example in this post says you should sell it and invest the proceeds in your taxable account.