How much should you worry about 2021?

Posted on December 25, 2020

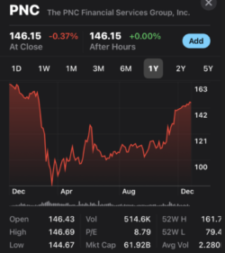

Merry Christmas!!! A week or so ago, I Zoom-attended a talk by Stuart Hoffman of PNC. Stu was Chief Economist for PNC for decades. You’ve probably heard him on NPR or seen him on TV. Stu has been recognized as an accurate forecaster of our economy. Stu’s annual talk focuses on how the economy affects investors. At the beginning of the talk, the audience took a poll on their prediction of the stock market at the end of 2021. After two well above average years, I picked 0% increase for 2021. His talk changed my outlook for the upcoming year: Stu predicts +10% for the stock market in 2021.

== We don’t control the market ==

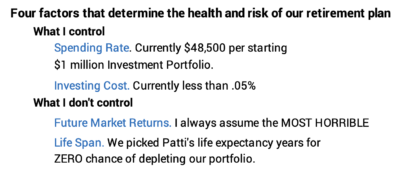

We nest eggers will ride along a future sequence of stock and bond returns that we don’t control. It will be what it will be. We can’t worry obsessively about something that we cannot control. We should worry about what it is that we can control: the two things that ensure we keep a healthy-enough portfolio throughout the rest of our lives. 1) We keep almost all that the market returns, and 2) we know what annual amount is safe to spend and we spend or gift that – not a dime more.

== What I really worry about ==

I do worry, though, about how bad could one thing be that we can’t control. “Are conditions such that we might be at the start of a MOST HORRIBLE sequence of returns?”

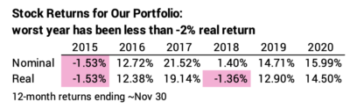

I DON’T WORRY about one year of bad returns that fall in what I consider the normal range of variability: I define normal as anything better than roughly -15% real return for stocks (See Chapter 7, Nest Egg Care [NEC]). Since the start of our plan six years ago, our worst return for stocks has been less than -2% real return. (The detail is here.) We have more now than we started with in December 2014. I clearly have not pulled out the worry beads.

THE WORRY is a sequence of returns that repeats that -15% annual return – or worse – several times over five or six years. Our withdrawal year-after-year magnifies the decline. Our portfolio value reaches a tipping point. It gets so sick that no rebound of returns brings it back to health assuming no change our spending. Our portfolio spirals down, and it ultimately depletes.

The MOST HORRIBLE historical sequence of returns that badly damages a portfolio would start with the six years of returns starting in 1969. That sequence started out badly – pretty steadily depleting portfolio value – and then hit two years that totalled -48% return for stocks. Killer! I’ve described that sequence and the terrible shocks – recessions and inflation – that led to a long period of decline here. You can see other painful sequences here.

== Is 2021 the start of a MOST HORRIBLE sequence? ==

Stu says, “NO.” Well, maybe that’s an overstatement since he predicted for just 2021. Stu predicts +10% return for stocks in 2021. Why?

• Inflation and Interest rates will remain low. The Fed targets to get inflation to more than 2%, the previous target for the ceiling. Inflation now is about 1%. Higher inflation is consistent with faster economic growth and lower unemployment. That pulls us out of the mess we’re in now.

Increasing inflation from a more robust economy is a heavy lift for the Fed. The only tool the Fed has to boost our economy is to keep interest rates low. Stu predicts the Federal Funds Rate – basically the rate banks lend or borrow among themselves – will stay close to 0% for the next three or four years. Those rates affect the rates for all borrowers. Stu thinks mortgage rates – lowest in our lifetimes – example won’t get much above 3%. They’re below 3% now. I’ve refinanced twice in the last 18 months, and I still missed the low point!

Stu does not think all the recent deficit spending will lead to high inflation. In 2010 many predicted a big wave of inflation from the fiscal and monetary stimulus to get us out of the Great Recession, generally the period 2007-2009. High inflation never happened. In no case does Stu see inflation getting out of hand. “Getting out of control” means Fed would have to raise interest rates to cool the economy.

• Corporate profits will increase and stocks are not over-priced. The recovery in stocks from the decline in February and March is now broad-based. (Stu has to be very happy about the recovery of PNC and other bank stocks.) Stu forecasts 20% increase in corporate profits.

Stu views stocks as fairly valued even though the current P/E ratio of stocks is high on an absolute scale. It’s not high on a relative scale. The 30-year bond rate – bond yield – is less than 2%. You can flip bond yield and say the price-earnings ratio (P/E) of bonds is greater than 50. That’s twice their historical average of bond yield of 4% or P/E of 25.

Conclusion: I was concerned about 2021: we’ve had back-to-back years that are well above average. Is this the year to come back to earth? After listening to Stu Hoffman from PNC, I’m not pessimistic about 2021. Stu predicts +10% for the market by the end of 2021: Low inflation; low interest rates; increasing corporate profits; stocks are fairly priced. Stu’s been reasonably accurate over many years. I hope he’s on target. That would mean another real pay increase – a real increase in our Safe Spending Amount – for Patti and me for our spending in 2022.