Does Social Security pay for the basics in retirement?

Posted on July 21, 2023

We saved for retirement to have money for the basics in life and to have money to enjoy life. This post discusses how much Social Security (SS) provides for a happy retirement. We retirees understand. SS benefits alone won’t cut it. We like those reliable monthly deposits that adjust for inflation each year, but SS benefits don’t provide enough for the basics in retirement. All should save for retirement, but many do not. I think more might if they understood how little SS will provide in retirement.

== Why do we want money? ==

I’ve written about this in a number of posts. (Here, here, here, here, and here.) We want money to pay for the basics of living. We want money to spend on the things that make our life happier now and in retirement. We want money to help make our family stronger and more successful. Giving money to others can make us happy.

== SS benefits and the Basics ==

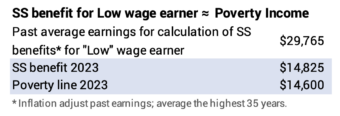

Social Security does not provide enough for what I would consider as basic living expenses. The poverty line in the US for a single adult is income of ~$14,600. That’s for food, rent, utilities, transportation, healthcare costs, clothes, and other basics. The poverty line for two is ~$19,700. Patti and I spend more than $20,000 with property taxes, utilities, and homeowners + health insurance. No food, transportation, clothes, internet or cell phone. Rent here in Pittsburgh averages $1,500 per month or $18,000 per year.

The Social Security benefit for a retiree with “Low” past average earnings of $29,800 – that’s about half the average of the median worker in 2023 – is roughly the poverty line. Benefits replace about half their historical average earnings. I’d assert that those who earned an average of $30,000 per year had almost no capacity to save and invest. All they have is Social Security. It doesn’t look like enough to me. I’m not sure how they make ends meet.

Almost 4 in 10 of those over age 65 would be below the poverty line without SS benefits. SS benefits lifts 3 in 10 of those over age 65 – 15 million – out of poverty. 1 in 10 remain in poverty after receiving their SS benefits.

== SS is a lower percentage for you ==

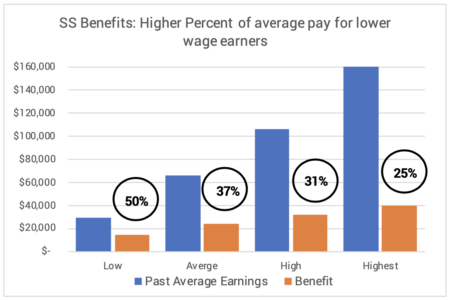

Your SS benefit is a lot less than half of your past average pay. It’s probably closer to 30% of your past average pay – and after taxes it’s likely less than that.

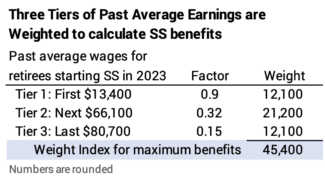

Reason #1: The math of calculating SS benefits tilts toward those with lower past wages. The math to calculate your benefit weights historical past wages in three tiers. For someone who chooses to start SS in 2023, the first ~$13,000 of income has the same weight in the calculation of benefits as does the last ~$80,000 of income. (The maximum subject to SS tax in 2023 is $160,200.)

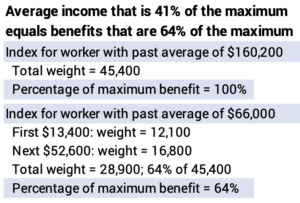

A person with $66,000 average past earnings who starts SS in 2023 has earnings 41% of the $160,200 maximum subject to tax, but receives 64% of the maximum benefit for his or her age.

Reason #2: Taxes on SS benefits may knock off about 20% of the pre-tax benefit. For Patti and me, 85% of our SS benefits are subject to tax. The effect is that we pay nearly 20% of the benefit back as income tax. If our benefits were 31% of past average earnings as indicated in the graph above, the after-tax benefit is sliced to about 25%.

An IRS worksheet determines the percentage of SS benefits subject to tax. It’s not a straightforward calculation. I explained it here and provided a spreadsheet that helps to understand the calculation. Those with low SS benefits and low income other than SS pay no tax on their benefit. An increasing percentage is taxed until it reaches the maximum of 85%.

Conclusion: Younger folks need to save and invest for retirement. We retirees understand: Social Security alone won’t cut it. Social Security benefits may replace a third of a retiree’s income during their working years. This is not enough for the basic living expenses they’ve gotten used to. And they should want much more than just the basics to be happy in retirement: to pay for experiences they’ll enjoy; to help their family be happier and more successful; to help others.