Do you own the KING of mutual funds?

Posted on June 16, 2023

In the long run, index funds will outperform: the chances are 15 of 16 that you’ll have as much or more in the future from an index fund than from an actively managed mutual fund. I am surprised that less than 20% of the value of US stocks are held by index funds. I’m surprised that so few investors hold what I judge as the KING of index funds: a US Total Stock Market Index Fund. This post points out reasons why this fund has to be the cornerstone of your holdings for US stocks whether you are younger – in the save and invest phase of life – or older, like me, in the spend and invest phase of life.

== Index funds outperform ==

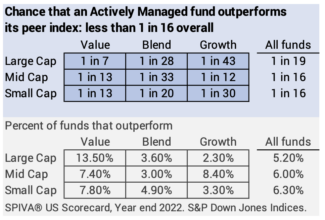

Index funds outperform their peer actively managed funds in roughly 15 of 16 chances. The other way of saying this: if you bet on an actively managed fund in an attempt to outperform the market, you will be will be on the wrong side of that bet 15 of 16 chances.

Why? Before consideration of costs, actively managed funds are playing a zero-sum game relative to index funds. Index funds buy and hold and earn returns that almost exactly mirror the total market returns. Actively managed funds trade among themselves: each highly paid fund manager tries to pick the winners from the losers. Since they are only buying and selling with other active fund managers, their returns in aggregate, before consideration of their costs, have to match that of the total market or index funds. That’s simple math and the zero-sum game.

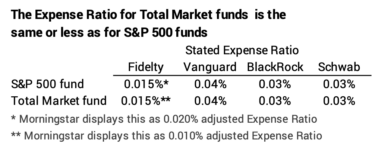

It’s less than a zero-some game for investors in actively managed funds when one adds in costs. An index fund will incur costs – expense ratio – generally less than 0.04%. This means index fund investors are keeping more than 99% of market returns. Actively managed funds incur costs of about 0.9% meaning that those investors, on average, keep 87% percent of market returns; they are giving up about 13% of the expected return year after year in the unrealistic chase to outperform the market. Compounding the difference in returns earned over time means investors in actively managed funds will have 15% to 20% less than index fund investors.

Some active funds do outperform. Their outperformance comes from the underperformance of other actively managed funds. Over 20 years, very few funds consistently outperform. Fewer than 1 in 16 active funds outperform their peer index fund in 20 years, as I described in this post.

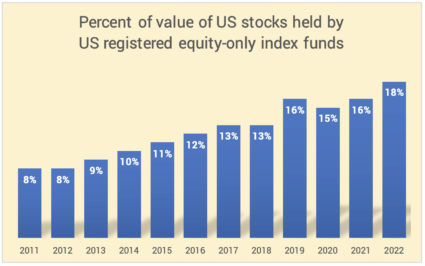

== Only about 18% is held by index funds ==

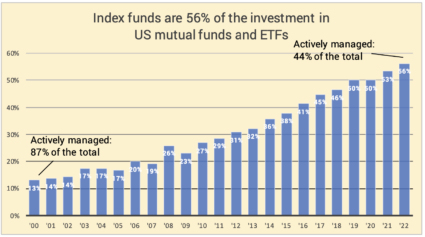

The latest report from the Investment Company Institute (ICI) shows the steady increase in Index funds relative to Active funds. In 2000, Actively managed funds dominated; only 13% of the total invested in US mutual funds were Index funds. Now its 56%. Investors in funds that invest in US stocks get the basic story: they win with Index funds.

I am surprised, however, that Index funds are less than 20% of all the investments in US stocks. That means many investors – individuals, hedge funds, pension funds, insurance companies and the like – hold individual securities; they don’t invest in mutual funds. I’d argue that they are active investors, otherwise they’d own an index fund: they aren’t going self-manage to match an index at lower cost than the the lowest cost index funds.

== The KING of funds ==

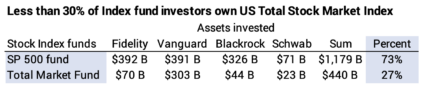

Investors in Index funds favor funds that mirror the original index fund started by Vanguard in the mid 1970s, the one that tracks the performance of the S&P 500 stocks – the 500 US-based companies with the largest market capitalization value. These funds hold each stock in proportion of its market capitalization value to the total value of the 500. The S&P 500 stocks are about 85% of the market value of all stocks.

I argue the better fund, the KING of mutual funds, should be the one that holds roughly all of +4,000 stocks traded in the US. But fewer than 30% of index fund investors own this fund.

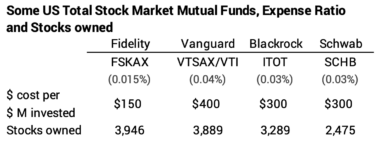

== Some US Total Stock Market Index funds ==

Patti and I own FSKAX as the sole holding for US stocks in our portfolios. It’s about 60% of our total portfolio.

== Four reasons ==

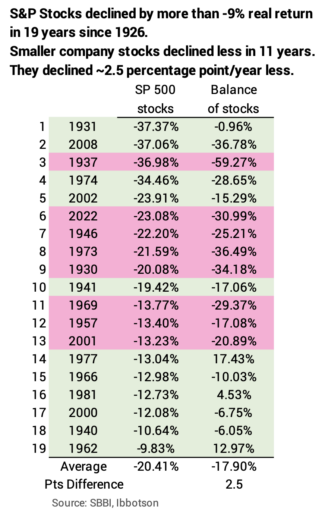

1. US Total Market fund is the ultimate in diversification. The addition of smaller company stocks tends to smooth the variation in the S&P 500 returns. Since 1926, S&P stocks have declined by more than 9% real return in 19 years. Stocks that were the balance of the market declined less in 11 of those years (58%). The decline for smaller company stocks averaged about 2.5 percentage points less. This is tempered by some years when small cap stocks declined more than large cap stocks: 2022 was the most recent example. They declined about the same in 2008 and less in the three-year period 2000-01-02 – the two other steep declines for stocks since 1973-74.

2. One might earn greater total return by holding the balance of stocks other than the S&P 500 stocks. Since 1926 these stocks have outperformed S&P 500 stocks by about 2 percentage points per year. They mightily outperformed S&P 500 stocka at the end of WWII and the last half of the 1970s. The returns over the last 40 years have been almost identical; they have lagged by about two percentage points per year over the past ten.

3. A Total Stock Market Index fund is actually combination of nine market-capitalization-weighted funds. I think it is impossible to construct a portfolio of actively managed funds that would outperform this index fund over time.

The market capitalization index for each of the nine boxes trounces the actively managed funds that concentrate on those boxes. The chances that an Actively managed fund will beat a peer, market-cap weighted index that is already a part of a Total Market index fund range from 1 in 7 (Large Cap Value) to 1 in 43 (Large Cap Growth).

I average all those boxes to make the general statement that only 1 in 16 (6%) of actively managed funds outperform their peer index funds. The converse is that an Index fund will return as much or more than an active fund in 15 of 16 chances. Since Large Cap funds are about 85% of the total market, it’s really closer to 18 of 19 chances that your stock investment in index funds will outperform.

4. Your investing cost to own a piece of all US stocks is low, low, low – the same if you owned an S&P 500 fund. You not giving up more of market return because of greater cost.

Conclusion. In Nest Egg Care, I recommend you hold a US Total Stock Market Index fund as the main building block of your portfolio. Patti and I own FSKAX which is about 60% of our total portfolio. About 18% of the value of US stocks are held by investors in index funds. About 30% of the investment in index funds is in a US Total Stock Market Index fund. Both of these percentages are somewhat shocking to me. They should be MUCH GREATER. This post restates the reasons why this fund is about the only security you should own for US stocks.