What’s the redemption value of your I-bond? When and how do you redeem it?

Posted on June 9, 2023

If you first bought an I-bond last year like I did, I suspect you are a bit confused on the redemption value of your I-bond, when to redeem it and how to redeem it. I was not clear when I wrote this post. This post explains how to find information to decide when to redeem and the steps to redeem. You’ll see my logic as to why I will sell my I Bond on August 1. I’m largely summarizing in writing this 25-minute YouTube video.

== I bond and interest earned ==

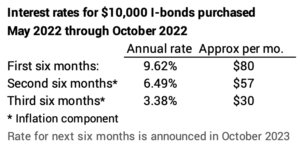

An I-bond earns a stated interest rate for six-month periods. Interest rates change every six months. I purchased my I-bond in the period of May – October 2022. I show interest rates applicable for my first three six-month periods. (This page has a more detail explanation of why I am earning an Inflation-component rate for all six month periods; my I bond has no fixed-rate component.)

Treasury posts interest from the first day of the month that you buy your bond. I purchased my I-bond on May 20. That means that for my first 12 months – May 1, 2022 though April 30, 2023 – I earned interest at about $80 per month for six months and at about $57 per month for the next six months. If you purchased in June, as an example, you earned the same interest for the year June 2022 through May 2023. This repeats for the purchase-months through October 2022.

== Current Redemption Value ==

You are eligible to redeem your I bond – have the Redemption Value deposited to your checking account – after one year. The first time I could have redeemed my I bond was this May.

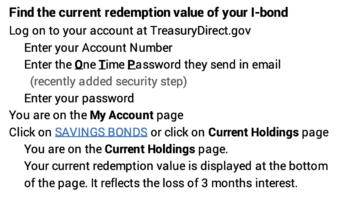

TreasuryDirect.gov shows the current redemption value of your bond. The value displayed reflects a three-month interest penalty. You incur the penalty if you redeem your I-bond before five years.

Follow these steps to find your current redemption value:

The redemption value displayed for June for my I bond is $10,704. (Treasury also shows Redemption Value for your bond before your one-year anniversary, but you are not eligible to redeem then; that value has no meaning to you.)

== Trust Treasury’s calculation ==

The YouTube video explains that Treasury’s calculation of monthly interest earned is not is straightforward, but my calculation of interest earned is within $1 of Treasury’s calculation. Trust Treasury’s calculation. You don’t need to absorb the detail of how Treasury calculates interest earned as described in the video.

== Redemption Value in Future Months ==

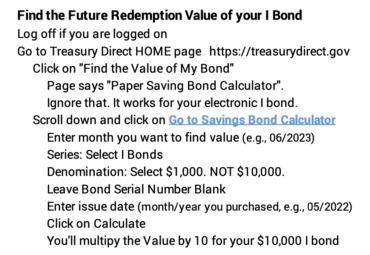

You go through these steps to find redemption value in a future month.

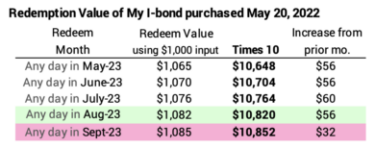

I found my value for redemption periods starting in May 2023 – the first month I could have redeemed it – through September 2023.

August is the last month that I keep interest at the 6.89% annual rate. September is the first month that I would keep interest earned at the 3.38% rate. I judge I will earn more than that elsewhere. My current money market yield is 4.7%, for example. Since I don’t want to earn at the 3.38% rate, I should redeem my I bond in August. I get the same amount any day that I redeem in August. I therefore should redeem my I-bond on August 1 and put it to work aiming to earn more than 3.38% annual rate.

If you purchased your I bond in June, for example, this schedule shifts one month. If you find the 3.38% rate unattractive, you’d sell your I-bond on September 1. If you purchased your I-bond in July, you’d sell October 1. And so on.

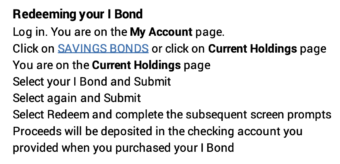

== Steps to redeem your I bond ==

This is what I am going to do on August 1:

Conclusion. I was a first-time buyer of an I Bond in May 2022. This post describes how to find your current Redemption Value – the amount you will receive when you redeem your I Bond after one year. It describes how to find your Redemption Value in future months; if you judge a six-month rate as unattractive, you find the first month that you want to redeem. The post describes the steps to redeem your bond.