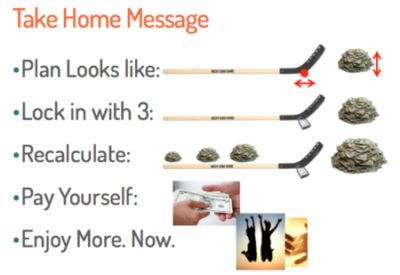

What’s the one-page Take Away from Nest Egg Care?

Posted on June 1, 2018

We have to start with the right questions. I think these two are the right distillation for us retirees.

I wrote Nest Egg Care to answer those two. Those five pictures above are the one page Take Away.

1. You should view your financial retirement in terms of a) a hockey stick and b) a pile of money,.

a. The plot of the year-by-year probability of depleting your portfolio looks like a hockey stick: many years of zero probability of depleting (the shaft length) and a rising probability thereafter (the blade angle). You determine the stick shape (and the size of the pile) by three key decisions, below. The most important variable that you want to control is the length of the shaft. We use a Retirement Withdrawal Calculator to give us the year-by-year probabilities. We always use the most horrible sequence of returns ever to determine shaft length for a set of decisions (see below).

You decide the number of years you want for ZERO worry. Using our life expectancies as a guide (Patti 70 and Tom 73), Patti and I chose an 18-year shaft length. We have no risk for 18 years and some risk thereafter. But 18 years is beyond each of our life expectancies; it’s just 8% probable that both of us are alive then; and we have many years to adjust if the returns we face are dismal. I discuss why 18 years makes perfect sense to us in Chaper 3, Nest Egg Care.

b. The expected future spending power of your nest egg is more than you have now. That’s the pile of money at the end of your stick. It’s the pile that would be there if returns are normal (not crazy abnomally bad) and you stick with your initial spending amount, just adjusting for inflation each year. For Patti and me, the expected pile in 18 years is 45% MORE than we have now.

2. Three decisions lock in shaft length and the size of your pile of money.

• Spending rate. This is the biggest control knob that sets the shaft length of your stick. Lower spending is a longer shaft (and bigger pile of money). Greater spending is a shorter shaft (and smaller pile of money). The two decisions below have an effect on the Safe Spending Rate (SSR%). The SSR% is 4.75% for Patti and me: that’s solid for 18-year shaft length and 45% bigger pile of money.

• Investing cost. I could argue this is more important than Spending Rate since low cost is so critical in ensuring that the rate is indeed safe. It’s a decision you must make, and most folks don’t even consider it as part of their financial retirement plan. Big mistake.

Investing cost is the deduction from aggregate market returns. We all incur some costs, but many retirees think they can overcome inherent costs and beat the market. They’re shooting themselves in the foot. Many incur two percentage points of investing cost and that equates to perhaps a 35% reduction from market returns. Patti and I decided on .10 per percentage point cost – 1/20th that of many others. We have about a 2% reduction from market returns. Our cost is easily achievable with index funds.

Our low investing cost also translates to a bigger potential pile of money. Ours is about two-thirds more – over $500,000 more – in purchasing power relative to an initial $1 million – than someone who incurs a two percentage point cost at our spending rate and stock-bond mix.

• Mix of Stocks and Bonds. This third decision is much less important than the first two, although many obsess over this one. A mix of more bonds has a surprisingly small positive effect on shaft length, but it has an outsized negative effect on the pile of money. I discuss the tradeoffs between spending rate and mix in Chapter 8, Nest Egg Care. Patti and I are perfectly comfortable with 85% stocks and 15% bonds: that’s rock solid for our 18-year shaft length at our low investing cost and 4.75% spending rate.

3. You must Recalculate often. The return pattern that we will experience almost certainly will be better than the one assumed that drives the initial (or current) Safe Spending Rate to a low level. Also, when you are older (let’s think 85), you don’t need to plan to have your money last as many years as when you were younger (let”s think 70).

Patti and I recalculate annually. Our Safe Spending Amount for 2018 is now 20% more than that for our 2015 spending. See here and here.

4. Pay yourself your annual Safe Spending Amount (SSA). (See Chapter 5, Nest Egg Care for details on the calculation.) You want to pay yourself so you can clearly see that you don’t overspend. But most folks, in my view, UNDERSPEND and UNDERGIFT while they are alive. Paying yourself has a big psychological benefit that lets you focus on point #5.

![]()

5. Enjoy More. Now. The sands of time are running. Statistically, you have less time left than you would like. Make the most of it. I have in my head that we’re given about 1,000 months; I’ve run through 875; 125 left. That’s maybe just 12 more summers with Patti. We have to focus on “What’s the next fun thing to do?”

And in a typical year – when we haven’t spent all that we’ve paid ourselves – we are able to ask, “Who should benefit from our increased giving ths year? And how much?”

This one thing is certain: you’ll enjoy your retirement more when you give to your loved ones and//or fund your favorite causes while you’re still around to appreciate the positive impact you’ve made.

Conclusion: You can view your financial retirement plan as a hockey stick and a pile of money. Your stick is the plot of the probability of depleting your portfolio for a given set of decisions on spending rate, investing cost, and mix of stocks and bonds. Your decisons on those three lock in the number of years of zero probability of depleting, and they lock in the expected future value of your nest egg at the end of the stick if returns are normal.

You must Recalculate often during retirement, since it’s almost certan that your annual Safe Spending Amount (SSA) can increase.

Pay yourself your annual SSA. Paying yourself has a powerful, positive psychological effect: you’ll focus on how to spend to Enjoy More, and you’ll know you can Give More while you are alive.