Should you rent when you are retired?

Posted on August 21, 2020

We should think about renting and not buying when we are retired. We should even think that selling our home and renting is NOT A HORRIBLE CHOICE. As the years roll by, I get more passionate about NOT SINKING CASH into non-financial assets – like our home. You want CASH OUT, NOT IN. I particularly want MORE financial assets – cash and investments on hand – in our taxable account; money there is valuable because it’s a low-cost source of cash for spending. I make some decisions to effectively rent and not buy. The purpose of this post is to describe how I’ve thought about rent vs. buy and how you might view the decision of selling your home to ultimately rent.

== Three decisions I’ll make to Rent ==

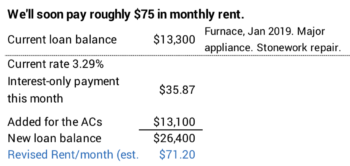

Our HELOC payment is Rent. I’ve had an interest-only HELOC for a number of years, but really didn’t use it. But now I use it for all home projects that maintain the value of our home. That means I use it when something breaks or is falling apart. I wrote a post about renting – in effect – a new furnace we had to install in January 2019. I’ve also included a stonework repair & landscape project. Now two ACs that sit on the roof of our house both went on the fritz in July. They’re scheduled to be replaced next week. That project will about double the rent we’ve been paying on our HELOC. We’ll rent our HVAC equipment and prior projects at about $75 per month.

The interest we pay on our HELOC isn’t exactly low cost. Our current rate is 3.3%, but the rate floats and very likely will increase over time. We don’t get tax deduction for the interest since we take the Standard Deduction. Therefore that 3.3% is my after-tax cost. That’s not expensive, but I do have money invested at lower return than this – short-term bonds in our Reserve [Chapter 7, Nest Egg Care (NEC)] are an example – but I really don’t want to touch them. I’m therefore paying more to rent: I pay a higher interest rate than I earn on some portion of our portfolio.

Our Mortgage payment is Rent. In effect, Patti and I rent about half our home. That means that over time, I’ve taken out cash – our current loan balance – that’s roughly equal to half the value of our home. I have to pay monthly rent in effect – principal and interest. I view that’s the same as if I had decided to sell half our home to someone else: they’d go to a bank, put up some equity, borrow the rest to finance the purchase, and then they’d charge me rent. The rent they would charge would include the effect of the principal and interest they’d have to pay and a profit for them. I’m getting a pretty good deal on this, since I don’t pay their profit margin.

I logically should fold in half of our property tax – use my HELOC to pay it – and include those added payments as rent. I just haven’t gotten there yet. I still pay our property taxes out of what I consider our FUN money – our annual SSA.

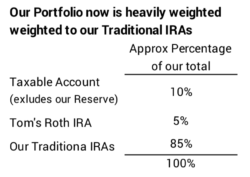

I value our mortgage. It’s an asset, not a liability, because it’s the major source of our money in our Taxable account. I could almost say that without our mortgage, we’d be close to $0 in our Taxable account.

Why is this? Over the years we’ve kept withdrawals from our Traditional IRA – and income taxes – low. That means I’ve preferentially sold securities in our Taxable account – at far lower tax cost – for our spending. We’ve let our Traditional IRAs run free as much as possible. Now the amount in our Traditional IRAs far outweighs the amount in our Taxable account. When you keep selling in your Taxable account to get cash for spending and get to be as old as Patti and me (we’re getting up there!), you may find your portfolio looks a bit like ours.

Lease future cars. We own our cars. I’ve never leased – effectively rented – our cars. One is six years old; the other is seven. We barely drive them now. I’m not sure when I’ll decide to get a new or better car. We’d be prime candidates for a self-driving vehicle if we could beckon one at will for all city trips, but that’s not in cards for the near future. I just can’t see laying out cash for a new or better car. I’ll lease, and I will not do the math to find the effective, relatively high interest rate I’ll be paying.

== The big decision: sell the house and pay rent? ==

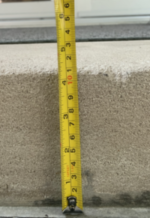

I don’t think Patti and I will ever sell our house. We bought it thinking we wanted to live in for the rest of our lives. Patti focused on accessibility. For example, we have two steps to get into our home from our sidewalk and driveway and the total height of the two steps is under eight inches. Here’s the picture of the biggest step.

But selling your home to eventually rent can be a very good move. A possibility is that you sell your home and move to assisted living.

My friend, Mary, is 77 and a widow. She’s active and in good health. She lives in a two-unit condo in a great location, one block from Walnut Street, Shadyside. She has ten steps up to the front door from the sidewalk, and her bedroom is on the second floor.

Mary thinks she might want to sell her home in a couple of years and move into an apartment with no steps to get in and no steps inside. How might that work out? I compare the two options relative to what Mary has been paying over the past 12 years.

• Including her current P+I, Mary spends about $2,000/month.

• Mary thinks an apartment that she might like in a location she might like would be $2,500/month. Heck, I’ll use $3,500.

• Mary thinks she’d net more than $450,000 on the sale of her home. Her condo has not appreciated much in the last 12 years; Mary would not pay capital gains tax on this sale. I’ll be conservative and assume she nets $400,000.

One way to look at this transaction: if Mary sells, she’d have $400,000 of cash proceeds and when she rents, she’ll have $1,500 added cash expenditure/month relative to what she pays now. Assuming 0% real return in the future – not a realistic assumption in my view – that works out to +265 months of rent – about 22 years.

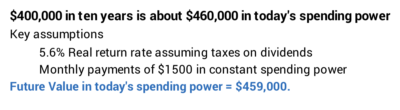

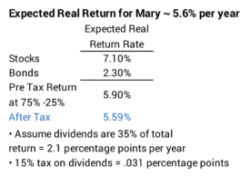

Maybe a more realistic look: Mary’s financial health – and the amount she could leave to heirs – most likely will be better if she rents. For this example, I assume future returns on that $400,000 are close to the average historical return rates for stocks and bonds. I use the Future Value calculation in Excel to find how much Mary might have in a decade. I’ll use dollars in constant spending power – that’s means I assume her rent increases with inflation each year – and real, inflation-adjusted return rates.

Mary starts with $400,000 and spends an added $1,500 per month. In ten years she’ll have $460,000 in today’s spending power.

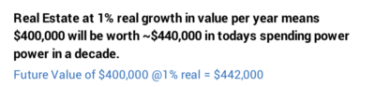

That $460,000 is probably more than Mary’s heirs would have if she never sold her home. Her condo has grown less than 1% in real value per year over the last 12. Real estate generally doesn’t increase by much more than 1% in real value over time. If I assume it increased by 1% per year in real value in the future, it would grow to $440,000 for her heirs.

Conclusion: An automatic default for most of our lives has been “Buy, don’t Rent.” Now that I’m retired and have reached my mid-70s, I’ve changed. I ALWAYS prefer to Rent, Not Buy. I don’t want to trade my financial assets for non-financial assets. I use my HELOC for the cash that my big non-financial asset – our home – demands over time: na new furnace and two new ACs are examples. My interest-only payments are the rent. In essence, we’ve sold half our home – to ourselves – and the P+I we pay is rent. None of us should fear selling our house to rent a place that is physically better for us: we can afford what appears to be higher cash outlays per month: it will likely work out to more money for us to spend to ENJOY or for our heirs.