Are we in a bull market?

Posted on July 7, 2023

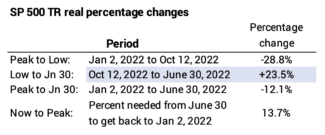

Yes, we are in a bull market. The start of a bull market is generally defined as the point when the market is 20% higher than the previous low. Our previous low was mid-October 2002. We passed 20% higher some day in June. As of June 30, we were roughly 23% above the low. We were not at the previous high in January 2022. We have another 14% or improvement to get back to that point.

It’s important to keep track of progress: we may be on track to rebound much faster than average, which would be very good news. I pointed out in this post that it took an average of seven years for the market to consistently surpass a decline similar to the one we had in 2022.

== Digging deeper: here are the specifics ==

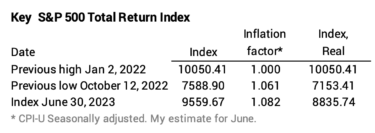

Inflation distorts our understanding, so I adjust the nominal measures of the market for inflation. I use the S&P 500 Total Return Index; that includes the effect of price and dividends reinvested.

The decline Jan 2, 2022 to October 12, 2022 was nearly 29%. The rebound to June 30 has been nearly 24%. We are 12% below Jan 2, 2022. We need about 14% improvement to get back to the Jan 2, 2022 level.

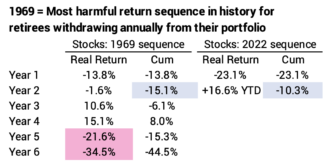

== 2022 vs 1969 ==

Since 2022 was so bad – the fifth worse one-year return for stocks in history – I want to compare it to the most harmful sequence of return in history for a retiree withdrawing from a portfolio each year for spending. That was the sequence that started January 1969.

It’s WAY too early to make a judgment on where the 2022 sequence is headed. The recovery so far this year is encouraging. (l always HATE to look at those stock returns in ’73 and ’74!)

Conclusion: We’re now in a bull market. The market crossed 20% above its prior low in June. We have to improve by 14% to get to the prior high at the start of 2022.