What will you do with the money you are not spending?

Posted on June 19, 2020

I looked online at our credit card balance, and I can see that we currently have a big NEGATIVE balance. That’s due to refunds on airline tickets for trips we had planned. It looks like our credit card payments for April, May and June will average roughly $1,500 per month – far less than normal. We keep paying ourselves our annual Safe Spending Amount (SSA) in monthly installments, and obviously the paychecks from Social Security roll in like clockwork. That means we are PILING UP cash in our checking account. Our plan is to spend or give all our SSA every year. We don’t save one dime. The purpose of this post is to describe our thinking of what we’ll be doing with the extra we will have.

== Retirees ain’t suffering. Yet. ==

We retirees are not financially suffering in any way – or in any significant way – so far. If you’ve followed the plan in Nest Egg Care (NEC), you have no reason to think your future annual Safe Spending Amount is in jeopardy. (See NEC, Chapter 2.) You’ve planned for the worst, and unless things really turn south, we aren’t remotely close what I would consider a poor year of returns. Our year-to-date return is about -1.2%. (Our calculation year runs December 1 – November 30.) The current 12-month inflation rate is about .1%, so that -1.2% or so is close to our real return.

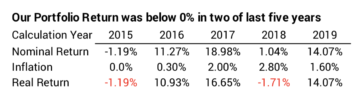

That’s well within the normal range of returns. Real returns for stocks have been below 0% about 30% of the years since 1926. Bonds below 0% for about 35% of the years. Our total portfolio declined in 2015 and 2018 by more than -1% real return, and I just took those years in stride.

Yep, it could get much worse, but I think I covered that risk. I sold enough bonds in March – very near their all-time high – such that I now have all our SSA for 2021 in cash. I don’t have to sell any stocks in early December. I can give stocks lots of to time to recover if they nosedive from here. If returns roughly stay where they are, it will be a normal December sale of stocks and bonds for our SSA for 2021.

== Who’s suffered? ==

The folks who are suffering are those with no savings and dim job prospects. That’s millions. Many were hurting before the checks for $600/week arrived. Cars lined up for miles here at our food bank. Some did not qualify and are still hurting.

Spending drives the economy, and spending has tanked. Spending has tanked largely because folks in our general category of income – with discretionary dollars to spend – account for about 50% of the decline in spending. This NYT article and this 3-minute NPR listen explain. And we retirees won’t suddenly get back to our spending habits: we know to hide from it UNTIL VACCINE.

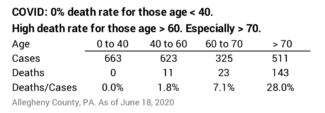

Those who have suffered have sacrificed for older folks like Patti and me. Our county isn’t representative of the US as a whole, but it’s useful to look at our data: no one under age 42 has died here. 0% death rate for those under age 40. The the death rate for those infected at 40 < age < 60 is 1.8%. The death rate gets to be very high for those age > 70. Oops, that’s Patti and me!

== Spend it. Somehow. ==

My conclusion: we’ve got to start spending, but we can’t really spend it on ourselves. Patti and I decided we should donate to help those who are hurting here. Get money to them. Let them spend it.

We decided to donate significantly to three organizations or programs over the last few months. We plan on giving more, since we won’t increase spending on ourselves for many months.

Food Bank. Our food bank is the big, central distribution center for about 400 food pantries in this region. In normal times it also provides direct distribution of fresh produce about 15 times a month at different sites in the county.

With COVID, the Food Bank opened an emergency pantry at their main location. The line of cars stretched miles the first time it opened. It opened 30 other drive-up distribution points.

The web site says $100 provides 500 meals. That’s $.20/meal. I think that’s what they pay for the fresh produce for a meal; the rest is free food delivered to them – food surplus that Department of Agricultural bought to stabilize farm prices.

Patti and I normally donate each December, but we donated again in March. I don’t know about the true math of $ and meals, but we may have provided one hell of a lot of meals!!!

Local Food Pantry. Pantries are the locations where those in need go to get food. I view the 400 pantries in SW PA as the retail grocery stores for the food bank. The food bank delivers to the relatively few larger pantries. The smaller ones drive to the distribution center to pick up dry goods they will pass out. A more established pantry has some financial capacity and spends for fresh fruits and vegetable.

Patti and I visited our local food pantry late last year to understand how it works. We were impressed. The food bank and pantries supplement what the Federal SNAP program doesn’t provide to qualifying poor households. SNAP helps with about three weeks of food for poor families; food banks and pantries generally provide about one week of food. Most pantries are totally volunteer run with very limited number of days and hours of operation.

Our local pantry is in the highest tier of quality in this region. It has staff – a terrific leader and employees. It’s open five days a week on a set schedule. It’s a small store. Clean. A volunteer helps every shopper. We could see that there’s a real, human connection there. This pantry provides far more than food: it’s clearly about self-sufficiency and helping to move a household out of poverty. Experienced staff engage their customers to understand their problems. Staff know the network of other social service agencies that provide help on employment, housing or other needs. Patti and I really like that aspect.

We donated for the first time this last December and donated again in March knowing they would see many more with needs. They told me that their parent organization received added Emergency Basic Needs fund from United Way and in nine weeks it helped 98 households get about $50,000 of financial support.

United Way and its Emergency Basic Needs fund. Our local United Way operates a call center that is part of Pennsylvania’s 211 help line. Most requests ask for help with housing (avoid eviction and foreclosure), utilities, and food. (Those three add to 60% of all requests in PA.) Recently calls are related to healthcare, food, and employment. (Those three add to 83% of all requested for help over the last 90 days.)

Our United Way has an Emergency Basic Needs fund to provide financial help to those suffering during this time. The fund is typically abour $1 million for the year, but donations during COVID raised that to $3 million, and the added $2 million is flowing our quickly.

Requests come directly from the public – their 211 calls – or requests are fulfilled by eight other selected/partner local agencies, like the parent organization for our local food pantry. We donated to this fund, adding a bit to the $2 million recently raised. Our donation will flow out soon and be spent by those with greatest need.

Conclusion. COVID: many older lives have been spared by the collective action of younger folks. Younger folks suffered economically and their prospects for good jobs are poor. Retired folks have not financially suffered. We retirees who have a nest egg likely are spending very few of our discretionary dollars and our collective spending is important to drive the economy. If you follow the process in Nest Egg Care, you pay yourself you Safe Spending Amount in monthly paychecks, and your checkbook is swelling. What will you do with it? Patti and I decided to use that excess cash to help those who have been helping us. We’ve donated to three local agencies over the last three months and will continue to do so.