July was the second month of low inflation.

Posted on September 1, 2023

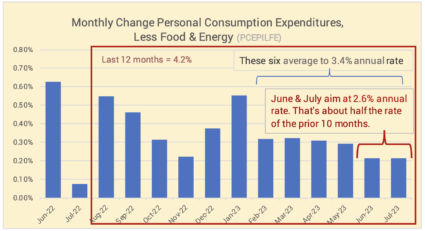

A final data point for inflation in July was issued Thursday morning. The important chart below is the one for Personal Consumption Expenditures, a measure the Fed favors. The rate for both June and July were about half that of the average of the prior two years and aim at 2.4% annual inflation.

Going deeper: below I display a table and the same six graphs that I’ve use to follow the trends in inflation.

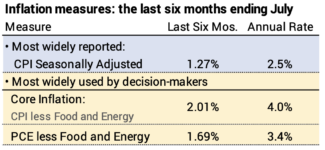

The two most widely-reported measures of inflation are Seasonally-adjusted inflation and Core inflation.

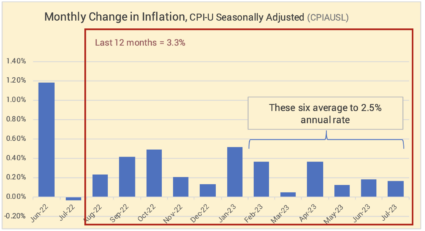

Seasonally-adjusted inflation increased by 0.17% in July. The rate over the last six months translates to an annual rate of 2.5%. Inflation over the past 12 months has been 3.3%.

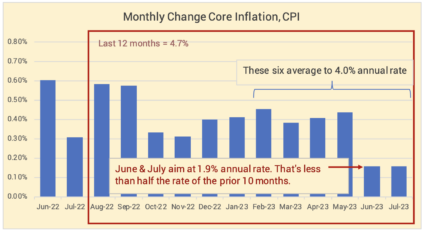

Core inflation excludes volatile energy and food components. This is similar to the measure below favored by the Federal Reserve. June and July are markedly lower than prior months. Inflation increased 0.16% in June and July. These two aim at an annual rate of 1.9% per year, less than half that of the prior 10 months.

Personal Consumption Expenditures (PCE) excluding Food and Energy is the measure of inflation is one that the Federal Reserve Board favors. The increase this month was 0.22%, almost the same rate in June. These two aim at 2.6% annual inflation.

The past 12 months of 3.2% inflation is an uptick from last month: this July ’23 replaced an abnormally low July ’22.

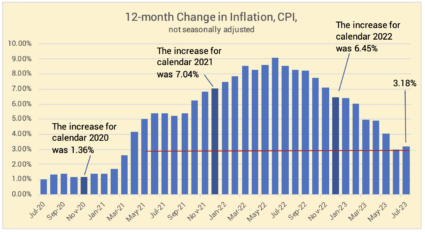

== History of 12-month inflation ==

Full-year inflation measured by CPI-U shows that inflation for the last 12 months has been 3.2%. This is slightly greater than the historical results in June: July 2023 was positive while July 2022 was a negative rate.

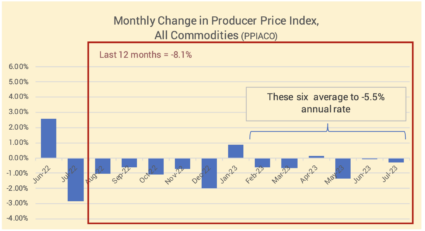

== Producer’s Price Index ==

The change in producer prices will impact consumer inflation. PPI over the last six months is at a -5.5%. annual rate.

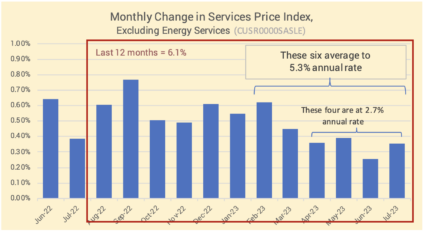

== Services ==

Inflation for services is trending lower. The last four months are at 2.7% annual rate as compared to 6.1% for the past 12.

Conclusion: The Core rate of inflation in July was 0.16%, the same as June; these two months aim at less than 2% annual inflation. The low inflation for July was repeated in the index of Personal Consumption Expenditures, the inflation measure favored by the Federal Reserve; June & July aim at 2.6% annual inflation.