Is this a better Rule as to how to use your bond insurance for your spending?

Posted on October 8, 2021

I have a new rule I recommend for selling bonds for your spending. The rule results in a safer financial retirement plan. It can add several years to your ability to take a full withdrawal for spending. The purpose of this post is to explain the rule: in most years, I will sell stocks and bonds for the upcoming year and rebalance back to my design mix of stocks. In rare years – when stocks steeply decline – I will solely sell bonds and use the resulting mix as my design mix from that point on.

I build this tactic into my action plan if stocks have declined steeply over the past 12 months – that’s the period of December 1 to November 30 for Patti and me. I sell securities for our spending the the first week of December for Patti and me. I calculate our Safe Spending Amount (SSA, Chapter 2) on our total portfolio. I no longer set aside a Reserve that I describe in Chapters 1 and 7, Nest Egg Care (NEC).

Reminder: bonds are insurance in your financial retirement plan. You’ll sell a greater amount of bonds when stocks perform poorly relative to bonds. You’re selling more bonds to give stocks time to recover. That’s it. You aren’t holding bonds to somehow smooth out peaks and valleys in the total value of your portfolio over time.

== Two weeks ago ==

Two weeks ago, I compared two approaches to selling bonds.

• The “usual” (Usual) approach is to sell stocks and bonds for your spending in proportion such that you get back to your design mix of stocks vs. bonds at the start of each year. If you picked 80% as your design mix, you’d sell the amount of stocks and bonds for your spending that gets you get back to 80% start of each year. You’re getting back to your full complement of bond insurance at the start of each year. This is the approach I’ve followed for the last six years.

• With a “Bonds first” (Bonds First) approach, you set an initial mix – let’s say 80% stocks – and then sell bonds for your spending until you’ve depleted them. You’re not really viewing bonds as insurance in this approach: you’re depleting them year-by-year unrelated to good or bad stock returns. After a few years your portfolio is 100% stocks. I showed that Bonds First provides the same level of safety as Usual – both provide the same number of years of full withdrawals for your spending in the stressful example I displayed.

== Test another alternative ==

I made up another rule to test. This is a “hybrid” (True Hybrid). 1) Use Usual in most all years: sell stocks and bonds for your spending such that you have rebalanced back to your original design mix before the start of each year. 2) Use Bonds First – meaning you solely sell stocks for your spending in a year where stocks have gone off the rails; I arbitrarily pick -10% real decline or worse return for stocks as off the rails requiring an emergency action. 3) But then use the resulting mix – a greater portion of stocks – as the new design mix. Rebalance back to that mix, not the original design mix in future years.

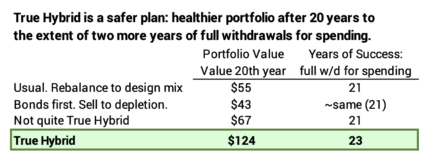

== Result: two more years of safety ==

I use same spreadsheet from two weeks ago to tell the story. That’s the maximum stress test that shows the weaknesses and strengths of decisions you’ve made for your financial retirement plan. The spreadsheet uses the Most Horrible sequence of stock and bond returns in history – starting in 1969. I use the same initial choice of stock mix of 80% that I used two weeks ago for the comparisons. I’m using a time horizon of about 20 years.

True Hybrid is superior. It gives two more years of full withdrawals for spending than Usual or Bonds First. That’s a meaningful improvement.

I get the summary information and conclusions from the detail of three spreadsheets.

#1. Usual is the reference case: sell stocks and bonds for your spending such that you are back to your design mix (80%) at the start of each year. (This the same base or reference case from two weeks ago.)

#2. “Not quite True Hybrid.” The rule is to sell only bonds when stocks decline by -10% or worse. That will result in a mix of more stocks at the start of the next year: 83% in our example. But in this option, you rebalance back to your initial design mix (80%) at the start of all other normal years. This isn’t significantly better than #1.

#3. True Hybrid is #2 with the refinement that you do not rebalance back to your initial design mix at the start of all other years. You use the resulting mix after you’ve solely sold bonds for your spending – 83% after the first year in our example – as your new design mix. Stick with this mix in the future. This could change again – to an even greater mix of stocks – if you hit another year of -10% return for stocks and therefore only sell bonds.

You may or may not use up all your bond insurance, depending on the number of craters that you hit. In spreadsheet #3, you would use up all your bond insurance – have a 100% stock portfolio – after hitting four HUGE craters in nine years! That’s a VERY UNUSUAL number of craters.

Mentally, I’d be Okay with True Hybrid and 100% stock portfolio in the future. With True Hybrid, I’m using bonds in the way that makes more sense to me: when I really want to avoid the damage of a steep drop in stocks.

== What’s happening ==

What’s happening with True Hybrid? You’re solely using your insurance in a very unusual year for stock returns, and you are not renewing it back to its full value after that year. You are implicitly assuming it is rare to hit a year of -10% real return for stocks. It is rarer to hit two and very rare to hit three throughout your retirement. You’ve hit a Most Horrible year. You’ve used some insurance. Don’t buy more insurance. Move on, expecting it will be rarer to hit another crater. Keep a bit more in stocks to give yourself the benefit when they recover, and they will recover. The result is a healthier portfolio.

Hopefully none of us see a year when stocks crater and we have to use this Rule. If you calculate your Safe Spending Amount (Chapter 2, NEC). for the upcoming year on the same day that I do – immediately after November 30 each year – you don’t have to remember how to execute this rule. You’ll see that in my post the first week of December.

Conclusion: You can improve your financial retirement plan by the way you sell bonds for your spending. I show an approach that results in a safer plan. 1) You solely sell bonds for your spending when stocks have gone off the rails: I use -10% real return as a guideline. 2) you rebalance thereafter to the mix of stocks vs. bonds that results from this action. In the severest stress test, this approach added two years of ZERO chance of depleting a portfolio. That’s a big improvement.