What’s the effect of 5.9% inflation on our spending for 2022?

Posted on October 29, 2021

Inflation has been 5.9% over the past year based on the way Social Security (SS) calculates its Cost-of-Living-Adjustment. (See here for how SS calculates.) That’s the most since 6.1% inflation in 1990. (See here.) The purpose of this post is to describe what that 5.9% means for us retirees. It’s pretty straightforward: inflation slashes the real value and real return rates on our portfolio, but portfolio returns for the year are on track to handily beat inflation. We nest eggers are on track for a real increase of our Safe Spending Amount (SSA) for 2022. (See Chapter 2, Nest Egg Care[NEC].)

== The basics ==

• Social Security gross benefits will increase by 5.9% to ~maintain the same gross spending power as in prior years. Your net monthly payment you receive will be affected by the increase in payments for Medicare premiums that are deducted from your gross SS benefit. Those premiums haven’t been announced yet.

• Your SSA for 2022 will almost certainly increase by more than 5.9%. You are on track to earn more in real spending power than you withdrew for your spending in 2021. When that happens, you always calculate to a real increase in your SSA.

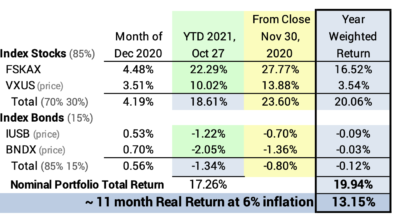

For example, Patti and I withdrew 4.85% in the first week of last December for our spending in 2021. We have less than five more weeks before my calculation of our SSA for 2022 on November 30. We have earned 13% real portfolio return over the past ~11 months. Assuming stocks don’t crater over the next few weeks, we’ll have the fifth real increase in our SSA out of the past seven years. These increases in our SSA are getting out of hand!

== Other effects of inflation ==

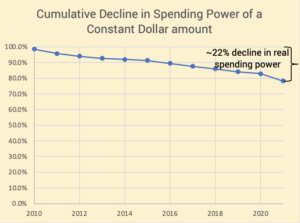

Patti and I have a component of our income for spending that does not adjust for inflation. I have a small monthly payment from a defined benefit plan from an employer in the early 1980s. The payments have been the same each month for nearly 12 years now. Year after year, the spending power of those dollar payments decrease. My pay decreased in real spending power by ~ 6% this year. The cumulative decrease in spending power from 2010 has been -22%.

While stocks gained in real value this past year – returns were greater than inflation – my bond portfolio declined sharply in real value. My nominal bond return is about -1.3% so far. With 6% inflation, that nominal return translates to about -7% real return. (That’s bad, but not wildly unusual: real bond returns have been -7% or lower twice in the last 20 years.) Stated differently, the real value of my bond portfolio fell by 7% this past year.

But the fall in the real value of my bond portfolio is offset quite a bit because I owe 6% less in real spending power on the money I’ve borrowed. The benefit of owing less in real spending power roughly matches the hurt of the decline in the real value of our bond portfolio.

Patti and I have a mortgage and a HELOC; I started our current 30-year mortgage in the summer of 2020 to take advantage of the low rates. Our total loan balance is not far off from my total bond portfolio. The real amount that I owe – our mortgage + HELOC loan balances – fell by 6% this year because of inflation.

How do I tap that? I only get the dollars that will increase my total financial assets to offset the real decline in our bond portfolio if I refinance in the future. I’d be converting the increrased dollar value in our primary non-financial asset to financial assets – dollars we can spend or invest.

Our home may not have increased in real value this past year, but it increased in dollar value due to inflation. If our house was valued at $400,000 last year, it is likely valued at 6% more or $424,000 this year. The dollar amount that we owe on loans remained the same or slightly declined with principal payments. Therefore, the ratio of my loan balance to the dollar value of our home is declining.

Someday, let’s say in 2028, a bank will be willing to lend me the same percentage loan amount to appraised value that I had in the summer of 2020. When I refinance, say at the same real mortgage value measured in spending power that I have now, I will get many more dollars that I can spend or invest after I’ve paid off the current mortgage. I’ve repeated this feat a number of times over the years. We always net more dollars to invest or spend after we’ve paid off the old mortgage.

Conclusion: Inflation over the past year has been about 6%. That’s the most since 1982. Your gross Social Security benefit will increase by 5.9%. Your Safe Spending Amount or your “pay” from your next egg will increase by more than 6%. Your overall portfolio return is more that the rate of inflation. You will earn back more than you withdrew for your spending for 2021. You will have more portfolio value measured in real spending power than when you withdrew for spending last year. When you earn back more that you withdrew last year, you will always calculate to a real increase in your SSA.