What do we do about the lousy returns for bonds?

Posted on April 1, 2022

Bonds have declined steeply since last September, by roughly -13% real return. Our brokerage statement shows that Patti and I are barely above water on our total bond holdings: the current market value for our bonds is only a shade better than the cost basis of my initial purchase +seven years ago, interest income reinvested, and my subsequent purchases of bonds. You should see the same result on your brokerage statement; you may even see that your cost basis for your bonds is greater than your current value if you started your nest egg plan within the last several years. The purpose of this post is to explain why Patti and I have such a low cumulative return for bonds and what I plan to do about the current poor prospects for bonds.

== The nose-dive ==

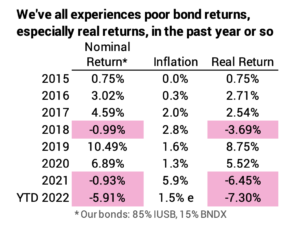

Bonds have nose-dived: inflation soared, especially in the latter half of 2021; interest rates rose; bond prices move in the opposite direction of interest rates and therefore the total return for bonds – the change in value from price and reinvested interest – has been negative. The recent decline is worse than the nominal decline. (You find the detail on our portfolio value and returns on this sheet that tracks our history.)

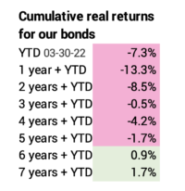

I can look back in time and find the cumulative return I earned from when I first invested, from interest reinvested, and from added purchases of bonds. The cumulative real return is below 0% for all holding periods with the exception of the amount invested in in late 2014 and for interest that was reinvested in 2015.

== I’ve bought a lot more bonds ==

I’ve bought a lot more bonds. You have, too, if you follow the steps to rebalance your portfolio after you take your withdrawal for spending for the upcoming year. For Patti and me, the negative returns on the most recent investments basically outweigh the small positive return we have earned on our initial investment in December 2014.

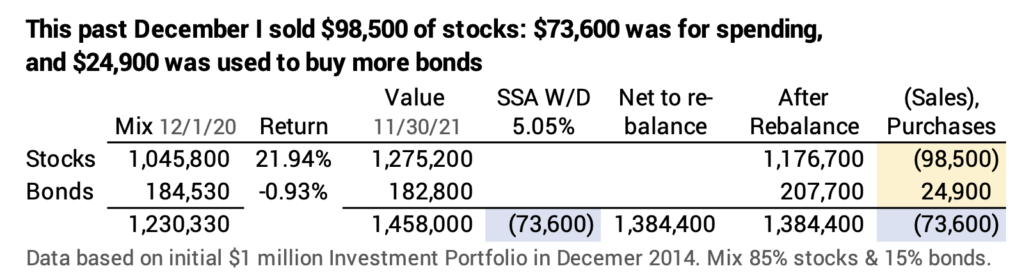

On the basis of an initial $1 million Investment Portfolio in December 2014, we had $143,400 in bonds after our first withdrawal for our Safe Spending Amount (SSA; see Chapter 2, Nest Egg Care). After our withdrawal and rebalancing this past December, I had $207,700 in nominal value in bonds. That’s 45% more in nominal dollars and 25% more in real spending power.

No period of return is close to 25% return and therefore the real increase is mostly – or even solely – from the added purchases I’ve made over the last seven years.

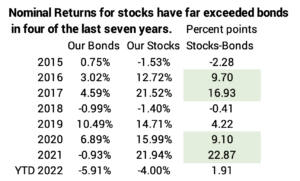

Why have I purchased that much more in bonds? The culprit, if you want to call it that, is the excellent returns for stocks over this period. Stocks returns far outdistanced bonds in four of the last seven years, highlighted below. When stock returns are that much greater than bond returns, I solely sell stocks for our Safe Spending Amount for the upcoming year, and then I have to sell more stocks to purchase more bonds to maintain a 15% mix for our total portfolio when I rebalance. You’ve clearly experienced this in the last two years if you’ve been following the process steps at the end of each year.

Here’s the example from this past December. It’s the most dramatic case, because the return difference was 23 percentage points. I solely sold stocks for our $73,600 for our spending and then sold another $24,900 of stocks to buy more bonds to maintain 15% bonds for our total portfolio.

== What to do? ==

I can bemoan the decline, but what should I do? I have two options:

• Switch to shorter-term bonds or even cash. Shorter-term bonds will decline less as interest rates rise. (The average duration of bonds for IUSB is 6.5 years. A short-term bond fund like VBIRX/BSV has an effective duration of 2.7 years.) Then I should switch back when interest rates have stabilized to earn a greater return.

• Ride it out.

You can guess, I think, what I will do: I will just ride it out. I may find this November 30 that I’ll again be buying more bonds to maintain our 15% design mix. But I just don’t think I’m smart enough to know when to switch to short-term bonds and then back to longer-term bonds.

Conclusion: Bonds returns have been very poor, especially over the last year or so as inflation accelerated throughout 2021: the cumulative real return over the last six months or so is about -13%. The nose dive means I have just two holding periods, 2015-present and 2016-present with positive real returns. The real returns on interest reinvested and any purchases in 2017, 2018, 2019, 2020 and 2021 are all below zero.

I’ve purchased more bonds in the years, especially in 2020 and 2021, and this does not help the overall picture. In years when stocks have dramatically outperformed bonds: I sell stocks solely for our spending, and I then have to sell more stocks to buy bonds to get back to 15% total for our portfolio.

While bonds are down, I’m not changing our bond holdings, primarily US Total Bond Market – IUSB. I could switch to shorter term bonds, since they would not decline as much as IUSB. Nor would they rebound as much. If I switch now, I judge I would not be good at knowing when to switch back to IUSB.