Is it time to get a mortgage or refinance your current mortgage?

Posted on September 20, 2019

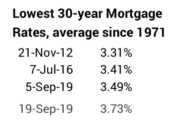

Is this a crazy question to ask someone who is retired or nearly retired? No! Mortgage rates now are low, low, low. The average 30-year mortgage now is about 3.7%. I summarize data from this graph that shows rates are within .4% of their lowest over the past 58 years. Patti and I want money to give to our heirs now, not after we are dead, and I view taking money out of our largest non-financial asset – our home – as a low cost source of cash. The purpose of this post is to explain my thinking of why you should consider a mortgage or consider refinancing your current mortgage.

I bet my thoughts about having a mortgage when retired or refinancing to a bigger mortgage is not what most retirees would consider. Most retirees I talk to want to get rid of any monthly payments. They want to own their home with no mortgage. That’s the comfortable decision. I get that no mortgage is comforting, but I make a different choice.

== Mortgage: always had one. Always will. ==

When I was in the Save and Invest phase of life, I did not want to invest too much in a non-financial asset – our home – that I thought would grow in real value only about one percent per year. (That turned out to be true.) I knew that over the long run I was going to do much better by investing in stocks that likely would grow somewhere between 6% to 8% real return per year. (That turned out to be true.)

When I borrowed – got a mortgage – that simply meant we put less of our savings into the 1% growth asset and had more money to invest in the ~7% growth asset. Yes, I had to consider the cost of borrowing, our real interest cost for a mortgage. But I always thought of that as no more than 3% per year, the nominal interest rate adjusted for inflation. 7% real growth (stocks) is more than 3% real cost (borrowing).

== I refinanced every 10 or 15 years. ==

When mortgage interest rates declined I’d refinance at a lower rate and always for 30-year term. In this example I use the mortgage rate we obtained in late 1977 and assume I refinanced in 1992. Here is the logic I followed:

1. Patti and I bought our home in Pittsburgh in late 1977. We had an $80,000 mortgage at 9% interest. That would equate to a mortgage payment of $640 per month. (I use a mortgage rate calculator or Excel® for these calculations.)

2. I decided we should be happy to keep the same real monthly payment over time. Our income increased by more than inflation over time, so paying the same real amount as in 1977 was easier. An inflation calculator tells me that $640 in late 1977 was the same – in real spending power – as $1,460 per month in late 1992. (Those 15 years were a horrible period of inflation.)

By 1992 – 15 years – I’d paid a total of about $115,000: $640*12*15. Let’s assume $25,000 of this was principal. That made our loan balance $55,000 in late 1992.

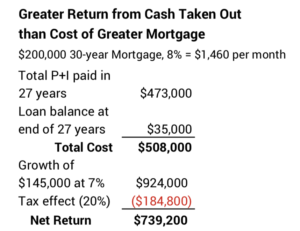

3. 30-year mortgage rates at the end of 1992 were 8%. Using the $1,460 that I was comfortable in paying, this is a mortgage of almost $200,000. Let’s assume our house appraised such that we could get a $200,000 mortgage.

4. I refinance. I borrow $200,000. I pay off the loan balance of $55,000. I take out $145,000 in cash to invest – essentially in stocks. If returns matched the long-run average of 7% real return rate per year, that $145,000 doubles every decade following the Rule of 72. That would be about $925,000 today. Yes, taxes on annual gains distributions would take a bite out of that, but if I never refinanced this mortgage, my net after taxes on that would exceed P+I payments for 27 years and the remaining debt balance on that $200,000 mortgage.

==Our new mortgage in 2007. My age 63. ==

Patti and I sold our first home and in 2007 moved into our current home less than one mile away. Our current home is smaller but much nicer; we have much more open interior space and nicer yard. After needed renovations it cost more than we sold our home for. I did not hesitate to get a bigger mortgage.

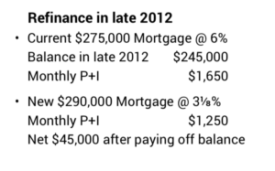

I’m not remembering the amount of our mortgage, but as I look back in my Quicken checkbook register I can see that our monthly mortgage payments were $1,650 per month. I can use the graph cited above and see the rate at that time was about 6%. Those two equate to a mortgage of $275,000.

== Refinance in late 2012. My age 68. ==

By late 2012 mortgage rates declined to their lowest level in 50 years. I was lucky and froze our rate at 3⅛% interest in December 2012 and finalized our current mortgage a few months later. My 3⅛% rate is lower than on the graph for that month.

When I refinanced this time I wanted to lower our monthly payment. I picked $1,250 per month, $400 per month less. That payment and the 3⅛% equated to a 30-year mortgage of $290,000. My mortgage balance on my original $275,000 loan was approximately $245,000. I therefore was then able to take out $45,000 in cash and lower my monthly payments by $400 per month.

== Would I consider refinancing now? Age 75. ==

Yep. Interest rates will never – I think – drop to my 3⅛% rate, but that would not be a key consideration. Patti and I have a goal to give more to our heirs now while we are alive. It doesn’t make sense to think that most of what they may get is when they split of the proceeds from the sale of our house after we are dead. The idea is to give them a piece of that non-financial asset now. Let them enjoy the money or invest it for their retirement.

I also view refinancing as a tax-free source of tax-free cash to give to them. I like the more than two alternatives that shrink our financial assets, and I’m not as comfortable in doing that now: 1) sell taxable securities and pay capital gains to get the net cash to gift; 2) withdraw more from our Traditional IRAs to and pay income tax to get net cash to give them.

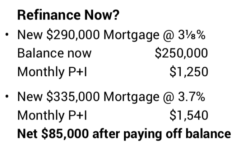

Here’s the approximate math on refinancing now:

1. I’ll assume we’d be happy with the same real monthly payment now as in 2012. We have a bigger nest egg now even after five years of withdrawals for spending since we’ve had very good returns for stocks since then. That means we would be happy to pay $1,540 now. That’s the same real spending power as $1,250 seven years ago.

2. At 3.7% borrowing rate, the $1,540 monthly payment translates to a mortgage of about $335,000. Let’s assume an appraisal would support that.

3. I get $335,000 from the new mortgage. I pay off the loan balance of about $250,000. Patti and I net $85,000.

== What’s the disadvantage? ==

We’ve tapped our non-financial assets such that we have diminished a deep, deep reserve to our financial retirement plan. I don’t consider this as a problem: 1) we already have a greater Reserve with our financial assets – more than two years of spending on average. (See Chapter 7 Nest Egg Care and “The Patti and Tom File” at the end of Part 2.). 2) Our Safe Spending Amount (SSA) has increased in real spending power by 20% since the start of our plan. It would be very easy us to lower spending back to our original SSA. Going back to this spending level would buy us a big, added margin of safety – more years of zero chance of ever depleting our Investment Portfolio.

Conclusion: I’ve had a mortgage and always will. I most recently refinanced in late 2012 and have a rock bottom 30-year mortgage rate of 3⅛%. Patti and I want to give money now to our heirs rather than after we are dead. A good option is to take money from our non-financial asset – our home. We’d do that my refinancing our current mortgage, and now is a good time to consider that option since mortgage rates are very low. If we did that – paying the same real monthly payment that we were happy with seven years ago – we’d net about $85,000 of cash, tax-free, that we could use for gifts.