Is Fidelity the new king of lowest cost index funds?

Posted on October 4, 2019

If you follow the evidence in Nest Egg Care (NEC), you know the key to investing when you are retired – really any stage in life – is to keep most all of market returns for yourself. To do this reliably you must solely invest index funds that buy and hold stocks and bonds to mirror the performance of the total market, such as the CRSP US Total Market Index of all ~4,000 tradable securities. (You can own also ETFs that track an index and trade like stocks.) This post looks at fund costs – the Expense Ratio – of key stock index funds. Fidelity holds the current title as THE SOURCE for low-cost index funds.

Basic conclusion: the cost difference between the largest index funds that try to mirror the US Total Stock market is tiny: you’re keeping about 99.5% of the market return for US Stocks with any of the top three. Other operational aspects of the funds means lower cost doesn’t exactly translate into higher net return to investors. I’m not switching my already low cost index funds for others that are lower in cost.

== Low Cost is Key for your Plan ==

Most retirees – most all investors – shoot themselves in the foot by making decisions that result in lower returns than they could easily get. We nesteggers reliably net the most out of the market because we only invest in index funds. The alternative of investing in higher cost, actively managed funds and thinking that they will outperform is a flawed logic. Paying an advisor on top of fund costs makes no sense: the decision of how to invest is straightforward. For more detail on the folly of actively managed funds and the bad effects of high investing cost see Chapter 6 NEC and blog posts here and here. You’ll see the logic and exact mix funds/ETFs that Patti and hold in Chapter 11.

== Three behemoths offer index funds ===

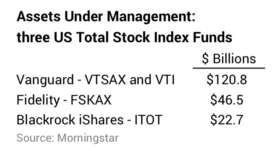

The three big providers of index funds are Vanguard, Fidelity and Blackrock. Vanguard offers funds and sister ETFs. Fidelity only offers funds. Blackrock only offers ETFs.

Vanguard implemented the first index fund in 1976 and is the giant of index funds and ETFs.

Fidelity was the largest mutual fund company in terms of assets under management until 2009 when Vanguard flew by it. Fidelity grew when investors poured money into several actively managed funds that outperformed other funds by a long shot in the 1980s, 1990s and into the early 2000s. (See last week’s post on Fidelity Contrafund®.) Many of its offerings for index funds – such as those that fit each category of style box – are less than one year old.

Blackrock offers iShares®, a family of over 800 ETFs, far more than any other company.

== The war to claim “Lowest Cost” ==

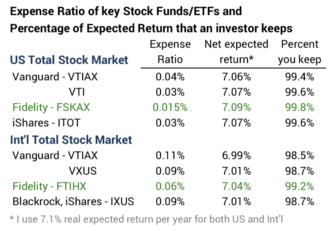

The Expense Ratio of index funds has fallen over the years. The three behemoths have repeatedly cut the Expense Ratio of funds and ETFs to claim that they are lowest cost. Last summer Fidelity lowered costs on its index funds to well below that of Vanguard and iShares. Vanguard lowered costs on an ETF Patti and I own – VXUS – in February. As a result, Patti and I now pay .05% expense ratio on our total portfolio. That’s less than a third if the default Investing Cost that I used in my favorite Retirement Withdrawal Calculator, FIRECalc, to get to our Safe Spending Rate (SSR%).

You can see a detailed comparison of Fidelity vs. Vanguard index funds here. I show the differences in Expense Ratio for the two key stock funds we retirees should consider. Fidelity’s Expense Ratio is one-third lower to half the cost of the same kind of fund from Vanguard or iShares. But the difference in cost is small: with any of these you keep about 99.5% of expected US Stock returns and about 99% of expected International Stock returns.

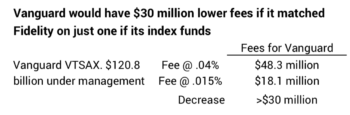

I don’t think fund costs can get much below these levels. Vanguard would have to cut their Expense Ratio in half on their biggest index funds to merely match Fidelity. That would be a cut of a very big dollar amount – over $30 million in management fees – on just one index fund and this one is not their biggest:

== Does lowest cost translate to better return? ==

We can’t conclude that lower cost for an index fund precisely translates to greater return to investors.

1. These funds and ETFs attempt to mirror an index, but Vanguard mirrors indices that are different from the ones Fidelity and iShares use. I’m guessing that fund companies didn’t pick the index they follow by judging it to be a better index. I’d guess that Fidelity and Vanguard, for example, likely picked different providers for their benchmark indices based on the negotiation of what they pay the companies that provide them: CRSP or SPDJ for US stocks, as an example.

2. Funds don’t hold all the securities that comprise an index and rely on sampling to capture the performance of many stocks. The total number of US stocks is about 4,000. The three funds hold roughly 90% of them. Funds simplify implementation and lower costs by sampling the stocks with the smallest market capitalization values.

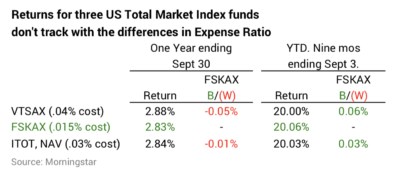

== Net returns don’t exactly track ==

I don’t see a consistent pattern that confirms lower Expense Ratio results in greater return for investors. I’d expect Fidelity to return roughly .015% to .025% per year more than either Vanguard or iShares. But the returns over last 12 months ending September 30 and nine months year-to-date wobble from that assumption. FSKAX performed better than its cost difference YTD but worse over the last 12 months; that means it was worse in the last three months of 2018. Maybe relative performance of the three will settle out to reflect the small cost differences.

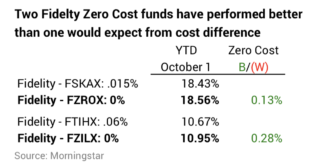

== Two Fidelity funds at 0% Expense Ratio ==

Fidelity really planted the anchor on low cost with two funds it introduced in 2018. These are incredible: NO Expense Ratio and NO minimum amount to invest if you have your money at Fidelity. I think over time folks are going to look at these anchors because they are so simple to understand. They will ask, “Why am I paying more than 0% for the funds I own?”

Fidelity did two things to lower its costs: it doesn’t pay a third party for a benchmark it is mirroring, and each of these funds holds fewer stocks than its peer index fund, meaning each fund relies more on sampling for the stocks it does not own.

The recent net performance of these zero cost funds has been better than the difference in costs. I’d guess this has to do with the luck of the sampling. I’ve not switched to these 0% cost funds. It would be easy for me to do since most of our money is in retirement accounts. I have no tax or transaction costs to change what we hold. (All of financial nest egg is at Fidelity.) I’ll watch until I understand if these zero cost funds will truly put a few more bucks in our pocket.

Conclusion: The fund cost – Expense Ratio – for index funds that track the total stock market is really low. For the fund that will be the largest holding in our portfolio – US Total Stocks – you should keep +99.5% of what the market delivers from any of three larger funds. The net returns to investors don’t precisely track by the differences in cost. I think you’re good with whichever index fund or you like; over time you’ll certainly be better than about 95% of investors. I’m not switching my already low-cost index funds for others that are lower in cost.