How was my experience with TurboTax?

Posted on February 10, 2023

Last week I decided to test run TurboTax to file my 2022 tax returns. I was lured by Fidelity’s offer of FREE federal and state tax return. I completed all the entries into TurboTax this week, and this post recounts my experience: it took me a lot longer than I thought it would to enter the information as a first-time user; I had two glitches that TurboTax solved very promptly when I finally asked for help. I know the results from TurboTax are accurate. I am very comfortable in filing my taxes using my FREE version of TurboTax. I’m a but surprised, but I feel a sense of accomplishment in learning how to use TurboTax. I’m looking forward to spending the $700 that we’ll save on something that Patti and I will ENJOY.

== My spreadsheets calculate our taxes ==

I would not have tried TurboTax without my independent calculation of total taxes due on our federal and state returns. The spreadsheet from last week’s post gave the answer for our federal return, and it was straightforward to calculate Pennsylvania taxable income from the data from my Federal return.

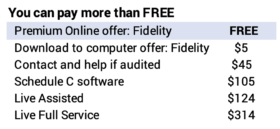

== I went for totally FREE ==

I took up Fidelity’s offer of FREE use of TurboTax. When I start on TurboTax and roll through the entry screens, TurboTax periodically displays options that cost more. I decided to stick with FREE. I used the on-line version and didn’t even pay the $5 to download software to my computer. If I have to pay extra to figure out how to correctly enter the data in to TurboTax, I’ll just pay my tax preparer here, even if that’s a lot more than paying the expert through TurboTax.

I shouldn’t need help. I will always include all the possible sources of income that are reported to the IRS; I can’t under-report income. Patti and I will RARELY incur expenses that exceed the standard deduction: 2022 is the rare occasion. It should be easy for me to enter all the data, especially if I enter the data when I get a tax reporting form and don’t wait to enter the data from all of them at one time as I just did.

== The flow with TurboTax ==

I had all my tax reporting forms by last Friday. This is the earliest I’ve had them in years. The flow of data entry is similar to the way I entered information on my spreadsheet: all items of income; all items of deductible expenses as the test of Schedule A vs. the standard deduction.

The input screens in TurboTax can be a bit tedious: if you want to check how you entered information for one 1099, for example, you can’t jump to that form. You have to roll through a number of screens and perhaps answer questions again that you’ve already answered, but I don’t see anyway around that bit of tedium.

== Downloads and reading of scans ==

TurboTax connects to Fidelity – and other brokers – and downloads the detail in their tax reporting forms. Fidelity provides 1099 DIV, INT, B and R forms. TurboTax connected and downloaded my mortgage interest form 1098. In some cases, you can link TurboTax to a document you have scanned, and it tries to import the information. I did that for several forms; that wasn’t always accurate, and I had to type in the correct information on one form.

I had to type in the information for about forms: our SSA-1099s; information for a 1099-R from a defined benefit plan; a 1098 mortgage interest statement for my HELOC. I had to enter the detail from two K-1 forms, and I had to go back several times and read the supporting schedules that came with them to correctly answer a few questions; that took a while to make sure I had all those entries correct.

I had assembled all the forms and expenses that I had in my Quicken, so I knew total that I had entered the correct total for gross expenses for Schedule A. TurboTax asks for an arrangement of medical expenses different from the way I keep them. I’m sure that format is just for recordkeeping and isn’t a requirement for the IRS, but I resorted our medical expenses to enter them into TurboTax’s format.

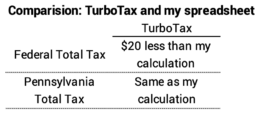

== Results equals Spreadsheet ==

The final result is that the TurboTax’s calculation of total Federal tax was $20 less than the amount I calculated with my spreadsheet; I’m not chasing down the detail of the difference. It was in total agreement with my calculation of PA total tax.

== Two issues with my State return ==

I had two data entry problems with our PA return and spent A LOT of time trying to resolve them – hours. That’s mainly because I tried to figure them out without asking for help. I had an overpayment from my 2021 return that I wanted to apply to this return, and I just could not find the data entry screen. I must have cycled through the input screens five times trying to find out where I entered the information on credits from prior tax returns.

We contributed to several 529 plans, and PA lets you deduct the amount contributed from other taxable income: contribute $5,000 to a 529 Plan, and you get a $5,000 deduction from taxable income; at PA’s ~3% tax rate, that’s $150 less PA tax. I could not get TurboTax to give credit for the full gifts.

I posed questions to the “TurboTax community” to get an answer. I did not get an response. I was FRUSTRATED. (I did get the correct response after my session with Franciso.)

== Help arrived FAST ==

I finally decided to hit the help button, not the one that triggered $124 for an expert. The screen said someone would call in five minutes, but Francisco called in one minute. I gave him permission to see my screen. A video of him appeared in a little window. He could point to items on the screen that I should select. He led me through the screens. We found the one with a box at the bottom, “See all tax breaks”; that did it for the overpayment credit I needed to enter. We still had a hard time resolving the glitch on contributions to 529 for the proper PA deduction, but we finally figured it out with him helping for MORE THAN AN HOUR. WOW. I had to change one detail on the page where I entered the contributions.

== I am pleased. A sense of accomplishment. ==

SUCCESS! I am pleased with myself. I am happy that I understand TurboTax. I am impressed with TurboTax’s service. Francisco spent an hour with me. I was also pleased that I also got an email within two hours from a TurboTax tax expert offering to help me more. All for FREE.

I will save $700 per year. Will I enjoy the $700? YES! I will think of really nice place where we will stay for our trip to England in August. Alternatively, I can donate $700 to Doctors Without Borders. Either choice will make me happier than spending $700 on tax preparation.

== Next year should be very easy ==

Next year I can start January 1 on our 2023 returns. I’ll start on a TurboTax return, hopefully FREE again. I get our SSA-1099s the first week in January, and I can enter the data into TurboTax. I can enter all the forms as I get them and the data from my expense summaries as I complete them. I’ll likely be spending no more than 15 minutes at a time with TurboTax. The total process will be painless. I’ve sketched out all my tax reporting forms and data gathering tasks for next year here. A schedule like this may help you.

Conclusion: I decided to try TurboTax for my tax return this year. Fidelity’s offer of FREE federal and state tax return with TurboTax was too good to pass up. I paid $700 to my local tax preparer last year. I completed my tax return in TurboTax this week. Date entry took longer than I thought it would. I was frustrated with two items, but TurboTax help was excellent: the person helping me spent an hour figuring out how to answer my questions! I was surprised at the prompt and thorough help, especially since I was a FREE customer – or was paid for by Fidelity. I know my federal and state tax returns are accurate with TurboTax. If I get FREE in the future, I’ll save the $700 every year in the future. I’m happy.

I’ve used TurboTax for over 20 years, and I couldn’t imagine paying someone to do my taxes now. The first year is always tedious because you have to fat finger in all the data. However, the second year, TurboTax accesses my prior year taxes (I buy the program and it’s resident on my MacBook.) so it automatically remembers who sent you 1099s and all your personal info.

It was most useful to me because I had several rental properties, and TurboTax would remember the depreciation and other deductions so I didn’t have to calculate them every year. I sold the rental properties last year, but TurboTax also tracks capital loss carryover from previous years so it still saves me a lot of time.

I’ve never used the free version so I don’t know if it can access your prior years tax returns (I keep mine all on a thumb drive so I don’t have to worry about someone stealing my data), but even if you pay for the lowest cost option, it’s worth it!

Tom, this is really helpful. I am waiting for my K-1 from the investment group and then I will have everything and fill out the forms that you provided. Thanks so much!