How important is your decision as to which fund/ETF you own?

Posted on April 9, 2021

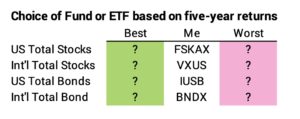

In recent posts, I’ve discussed your choices for US stock funds, International Stock funds, and US bond funds. Pick any of four US total stock market funds, any of eight International stock funds and any of about seven or so US bond funds, and I think you have an excellent retirement portfolio. In this post, I look back over the last five years to see how much better off I would have been if I had picked funds that did better than the four I picked. I conclude that you really can’t make a mistake if you choose from the ones I’ve listed in those prior posts – the return difference from worst picks to best picks is small in my view. It turns out that the biggest difference in results for Patti and me stems from my choice of US bond fund/ETF.

== Chet vs. Tom ==

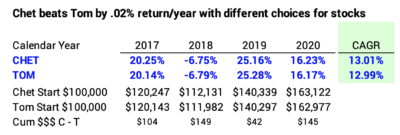

My friend Chet and I picked two different stock funds for our portfolio, and we compare at the end of each year. We assume we start the year with the same exact weights of US vs. International for stocks and bonds and mix of stocks vs. bonds. For US stocks, Chet owns ITOT while I own FSKAX. For International stocks Chet owns VEU while I own VXUS. Our choices of bonds are the same. I display the results over the past four years. Chet is just killing me by .02% in return per year. If we both started with $100,000, he is up by $145.

The point is that any four total market funds are going to give about the same result.

== The best and worst vs. my choices ==

I can look into the extremes of performance. I displayed funds or ETFs you can pick from in the prior posts. Some did better and some did worse over the past five years than my choices. Example: over the past five years for US total stocks, VTSAX was .03% better per year than FSKAK in annual return. FSKAX was .06% better per year than SWTSX. This table show the best and worst and my picks.

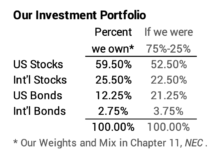

I then apply the percent Patti and I own of each. The percentages come from my decision on weights and mix in Chapter 11, Nest Egg Care.

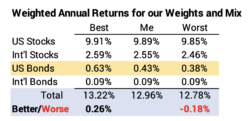

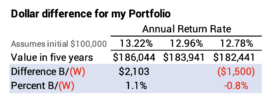

Now I can calculate the total return rates for our portfolio. The result is that perfect picking would have been about .26% better return per year and least perfect would be about -.2% lower return.

Had I made the perfect choices, I could have had $2,100 more per each starting $100,000: 1.1% more. If I made other choices, I would have $1,500 less: 0.8% less. Am I going to beat myself up about my picks because they weren’t perfect? NO. I am almost certain that my choices mean I’m in the top 10% of all investors or will be in a few more years. There always will be someone who weights (US vs. International) or mixes (stocks vs. bonds) their portfolio differently than I do and will pick better funds than I do. I can’t worry about that.

== Choice of US bonds ==

The comparison shows where I could have gained the most: .20 percentage points out of the total .26 percentage point difference is from my choice of US bonds. I picked a US total bond fund – IUSB. IUSB has the characteristics – average maturity date of all the bonds it holds – of an intermediate bond fund. I could have done better with a similar actively-managed total bond fund FBND. That’s the ETF of FTBFX.

I could have even done better if I decided to narrow in on intermediate corporate bonds, LQD. I would have done even better than that by owning long-term bonds, BLV (total LT bonds) or VCLT (corporate LT bonds). That’s about the only tweaking that would make sense to me, but I’m not inclined to tweak.

Conclusion: You have a fairly narrow choices for US total stock market, International total stock market, and US bond funds. I’ve described your choices in recent posts. You’ll be fine if you pick any that I’ve listed. You’ll be in the top ranks of all investors over time.

Looking at the last five years, better picks for Patti and me would have resulted in about 1.1% more for our total portfolio, but I’m not going to beat myself up that I didn’t make perfect picks. I know I can never be perfect in our choices. Three-fourths of that 1.1% we could have earned is explained by my choice of US bond fund. I’m not driven to change my past choice – IUSB – but it’s the one area I could tweak.