How do you use the money you have in a Roth IRA to avoid paying tax?

Posted on May 7, 2021

With proper use of a Roth IRA, retirees with higher retirement income can avoid paying taxes that they just don’t need to pay. This post describes how to use your Roth IRA to avoid paying tax of about $850 per year (single taxpayer) or $1,700 per year (married, joint taxpayers). You can avoid paying increased Medicare Premiums – effectively an added tax – typically deducted from your Social Security benefits.

I entered the data from this year’s Form 1040 on the spreadsheet I’ll use in early August for my tax plan for our 2021 return. This led me to think more about my Roth IRA and the best way to use it to avoid taxes. I’ve written about Roth and increased Medicare Premiums before (here, here, and here), but this post is more specific on how you use Roth to best tax advantage.

== It’s a bit of effort for $850 per taxpayer ==

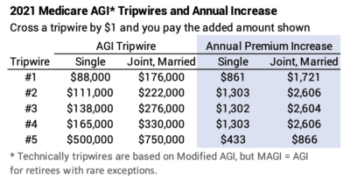

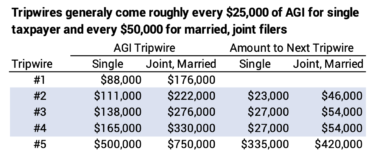

This post applies to those retirees with higher retirement income. Your Adjusted Gross Income (AGI) – that’s line 11 on your Form 1040 for 2020 – has to be close to, or greater than, $90,000 for a single taxpayer and $175,000 for married, joint taxpayers. At those AGIs you are close to crossing or have crossed a tripwire for higher Medicare Premiums – a tax, in effect, that you may be able to avoid.

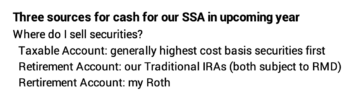

The potential payoff is about $850 per taxpayer per year – $1,700 for married, joint taxpayers. The effort is to plan the tax that you’ll pay your 2021 tax return. I formally do this in early August; for one I need to be close to the amount I’ll withhold from our RMD distribution in December for our total taxes for 2021. I also decide the sources I’ll use for the cash for our Safe Spending Amount for the following year (SSA; Chapter 2, Nest Egg Care [NEC]), and my choices will determine our total AGI and how much tax Patti and I will pay.

== Basic Economics: Roth = Traditional IRA ==

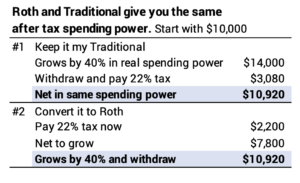

We need to start on the same page, and many people are confused about this: a Roth IRA has the same basic economic benefit as a Traditional IRA. Let’s just focus on converting Traditional to Roth: if the tax rate at the time you convert from Traditional to Roth is the same as when you withdraw from Roth for your spending, both give you the same after-tax dollars to spend.

Assume a couple, Herb and Wendy, pay 22% marginal tax when they convert an amount from Traditional to Roth. They will NEVER LOSE MONEY when they use Roth for their spending rather than their Traditional IRA; their increasing RMD almost guarantees that they’ll never be in a lower marginal bracket. They MAKE MONEY if they use their Roth and avoid more than the 22% tax that they paid.

== Get more from Roth than you paid for it ==

Herb and Wendy will earn more than 22% in two ways, but they get the biggest bang for their buck now by avoiding higher Medicare Premiums.

• They can use their Roth IRA to avoid withdrawing from their Traditional IRA at a 24% or higher marginal tax bracket in the future. Two factors drive all retirees toward a higher marginal tax bracket in the future: 1) at normal returns, RMD will double in real spending power in about a decade or so; and 2) (unfortunately) at some time just Herb or Wendy will be alive and pay taxes as a single filer; the start of 24% and other tax brackets will be half as distant as now for married, joint filers. This post describes that some retirees will find themselves paying A LOT of tax in the 32% marginal tax bracket when they are in their 80s.

• They can use their Roth IRA now to avoid paying higher Medicare Premiums. Assume both Herb and Wendy are on Medicare and receive Social Security. Medicare Premiums are deducted monthly from their gross Social Security benefit. The base deduction this year for each is $148 per month. The amount deducted increases – that’s really an added tax – as their AGI crosses tripwires of income. Cross the first tripwire by $1, and it will cost $860 or more per taxpayer. It’s more for other tripwires.

== Avoid higher Medicare Premiums ==

How can Herb and Wendy use Roth to avoid paying higher Medicare Premiums? They use some Roth for their spending and not their Traditional IRA. That lowers their AGI to stay below a Medicare tripwire.

The assumption is that in a normal year, Herb and Wendy withdraw more than their RMD for their spending: SSA is always greater than RMD for all of us retirees. Almost all of us will withdraw more from our retirement accounts than RMD at some point. Patti and I already do.

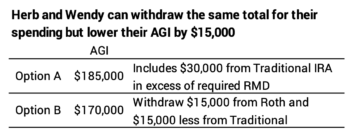

Here’s the example: Let’s assume Herb and Wendy have $170,000 AGI on their 2020 tax return. That’s in the 22% marginal tax bracket and below the first Medicare tripwire at $176,000. They estimate AGI to be $185,000 on their 2021 return. This includes withdrawing $30,000 more than their RMD from their Traditional IRA.

The $185,000 AGI remains in the 22% marginal tax bracket (Their Standard Deduction of $27,700 lowers Taxable Income to $157,300.), but it crosses that first Medicare tripwire. They would pay $1,720 higher Medicare Premiums. They’ll see that as lower net Social Security monthly payments in the calendar year after they file their 2021 return – 2023 since their 2021 return will be filed in 2022.

Instead, Herb and Wendy decide to withdraw $15,000 from Herb’s Roth IRA and $15,000 less from their Traditional IRAs. That’s the same total gross amount withdrawn for their spending, but it lowers AGI by $15,000 to $170,000, below the tripwire.

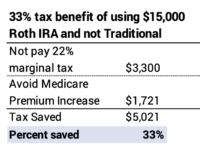

What have they saved? They avoided the same 22% marginal tax that they paid when they converted plus another $1,720. They saved, in effect, 33% marginal tax. This is the best immediate use of Roth IRA.

== Tripwires come every $25,000 or $50,000 ==

Herb and Wendy cross the next three Medicare tripwires every ~$50,000 of added AGI. A single taxpayer crosses a tripwire every ~$25,000 of added AGI. That means, on average, prudent use of Roth of about half those amounts each year could lower AGI to avoid a Medicare tripwire. If Herb and Wendy wanted to have enough in Roth to make sure they could use it to avoid a Medicare tripwire for the next ten years, they’d want roughly $200,000 to $250,000 in their Roth account.

== The plan to convert Traditional to Roth ==

If you don’t have enough in your Roth IRA, it’s similar planning to figure out how much to convert from Traditional to Roth in a year.

Let’s assume Herb and Wendy want to add to their Roth IRA by converting from Traditional this year. They have to estimate their AGI for 2021. The amount they convert would increase their AGI, but that amount must keep then in the same 22% marginal tax bracket and not cross a tripwire of higher Medicare tax.

It’s hard to successfully convert Traditional to Roth when you are subject to increased Medicare Premiums. In the example of estimated $170,000 AGI, Herb and Wendy can’t convert any significant amount to Roth without crossing that first Medicare tripwire. Lesson: build enough in your Roth account when you are younger and not subject to the penalties of increased Medicare Premiums.

Conclusion: I normally plan our taxes for the year in early August. I filled out my spreadsheet for a quick estimate for 2021 this week and thought about ways to withdraw for our spending that resulted in lowest taxes. Patti and I typically withdraw more than our RMD at the end of the year for our spending in the upcoming year.

I conclude that best use of my Roth IRA is to control our Adjusted Gross Income (AGI) so that we don’t cross a Medicare Premium tripwire that will cost us $1,700 in annual pay from Social Security. I lower AGI when I withdraw from our Roth IRA and not our Traditional IRA. I’ll see how this really might work out for 2021 when I complete our tax plan for the year in early August.