Have we reached the tipping point for the demise of actively managed funds?

Posted on September 13, 2019

This article states that in July the amount invested in passive index funds passed the amount invested in actively managed funds: roughly $4.2 trillion each. The first Index Fund started in 1976. That means it took 43 years for Index Funds to win 50% share of all investors’ money. Is this a tipping point? Will Index Funds continue to gain share? What’s that mean for those of use who invest in Index Funds?

== Index funds will increase share ==

The arguments favoring Index Funds are too powerful, and more investors understand the arguments.

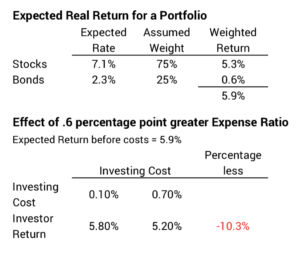

• Actively managed funds in aggregate must underperform index funds by their higher costs. That’s just simple math. The article above says the average cost of Index Funds is 10% of 1% of assets invested (.10%) and is 70% of 1% (.70%) for Actively Managed funds. Index cost = 1/7th of Active. That’s a cost difference of .6 percentage points in return per year. For a portfolio mix with perhaps 5.9% expected real growth per year, that’s about 10% less in annual return.

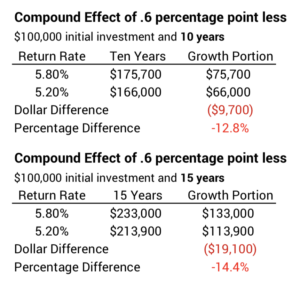

A .6 percentage points or 10% lower return rate over, say, ten years accumulates to a larger percentage difference in dollar growth. The difference expands with more years.

[My total Investing Cost is less than 5% of 1% (.05%). That’s 1/14th of the average for Actively Managed funds. That’s a bit more money in my pocket over a decade.]

• A rare few actively managed funds can claim to outperform and their outperformance is not consistently better. SPIVA reports show us that: see here and here for my most recent summaries. Fewer than 6% of Actively Managed funds beat their peer index in a decade. Those that do outperform don’t consistently outperform over time. There is no predictive power in thinking that outperformance over one period extrapolates to future outperformance.

The article above has a link to another article discussing the Capital Group, the fund manager of AGTHX, the fund I discussed last week. It’s a vocal defense of Actively Managed funds. AGTHX did have a very good run in the early and mid 2000s; it did not decline nearly as much as it’s peer index during 2001-2002 and in 2008. It looks good when you include those years.

But how relevant is a fund’s performance more than a decade ago? Last week’s post shows its performance against its peer index – Large Cap Growth – has been DISMAL over the last decade. It’s under-performed its peer Index Fund (VONG) by 2.6 percentage points over the last five years. That translates to 20% lower return rate. And AGTHX has a front end 5.75% sales charge that goes to a financial advisor. Add the on-going annual charge to an advisor, and the effect is REALLY DISMAL.

I like the quote highlighted in the article: “People are too fixated on fees. They should be fixated on their total return after all fees.” Well, yeah. That’s exactly what last week’s post and those SPIVA reports show: it’s almost certain that you keep more money – you have higher return – when you pay less to the financial gurus.

• The anchor has dropped to 0% cost for index funds. We tend to gage everything against an anchor – our quick simple understanding of the Investing Cost of funds, for example. Investors know the cost of Index Funds is low, but the anchor – what does low cost really mean – was not really clear. Fidelity planted that new, obvious anchor in August 2018 when it started two stock funds at ZERO PERCENT Expense Ratio. FREE. And now there are two more of these ZERO COST funds at Fidelity. An anchor of NO COST is much clearer, much more obvious than LOW COST. An investor has to ask, “What exactly am I getting by paying the financial folks more than ZERO?”

== Do Index Funds distort prices of stocks? ==

The article states this argument: investments in Index Funds result in too high of prices for stocks. They don’t react to changes in the market. Index Funds will add volatility to returns. This makes no sense to me. Index Funds just buy at prevailing prices to deploy investors’ money and then they hold; they don’t transact after they’ve deployed investors’ money. Actively Manage funds and individual investors do all the buying and selling after that, and that’s what determines the price of securities. And they’re only buying and selling among themselves. Actively Managed funds create volatility or diminish it. Not Index funds.

If it were true that the growth of Index Funds results in over-valuation, one would have to conclude that Actively Managed funds must be improving in their performance relative to Index Funds. But this is not the case.

Conclusion: After their start 43 years ago Index Funds now have more invested in them than Actively Managed Funds. This trend will continue. The arguments for investing in Actively Managed funds are just too poor. They mathematically have to underperform in aggregate by their higher costs. The average amount they underperform – roughly .6 percentage points per year – is a big deal. That is likely 10% of future growth of an investor’s portfolio, and that difference compounds to a bigger dollar difference over time. Only a few Actively Managed funds – perhaps 6% – manage to outperform, and there is no predictive power as to which one today will outperform in the future.