Category Archives: Uncategorized

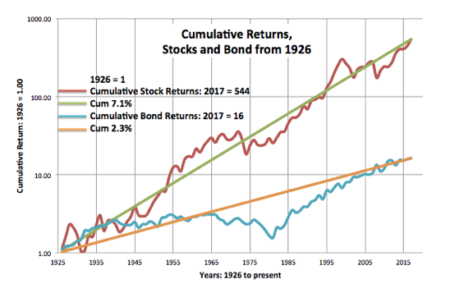

Stocks Real = 7.1%. Bonds Real = 2.3%

I’ve shown this graph in prior posts (download full view here), but the purpose of this post is to look at this graph in more detail and to better understand the implications for our financial retirement plan.

This is the plot of cumulative

Think Real. Not Nominal. You’ll understand more clearly.

I always like to think of future financial returns in terms of inflation-adjusted dollars, generally called constant dollars. These are dollars stated in the same purchasing or spending power of some base year. Current dollars are the nominal count of the pieces of paper

Once you’ve LOCKED IN SAFETY, Maximize the Pile of Money

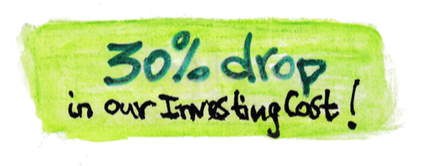

The last post shows that you LOCK IN SAFETY – the number of years you want with no chance of depleting a portfolio – with three key decisions: Spending Rate, Investing Cost, and Mix of stocks vs. bonds. Different decisions on those three can lead

FIRECalc vs. the 4% Rule: Which One Wins?

FIRECalc wins. FIRECalc gives us retirees the right data for the key decisions we must make for our retirement plan. My independent calculations agree with FIRECalc’s and not with those from the 4% Rule. I am more confident that Patti and I have a solid

Can you pick a winning Actively Managed fund based on its past results?

The SPIVA® report, “Does Past Performance Matter? The Persistence Scorecard” answers the question. Don’t count on an excellent track record of performance of an Actively Managed fund to extend into the future. Excellent performance does not persist. Only a very small percentage of

What are your mid-year To-Do’s for your Retirement Plan?

I read this article this week, “6 Portfolio To-Do’s for Retirees at Midyear”. I don’t do ANY of the six. This post describes what I don’t do mid-year and why.

Here are the steps in the article:

1. Check your year-to-date