Category Archives: Uncategorized

Would you rent your furnace for $36 per month? I did.

I now have made two monthly payments that are, in effect, rent on our new furnace installed right at the end of last December. As I mentioned in this post, I decided not to use our financial assets to invest into non-financial assets. This

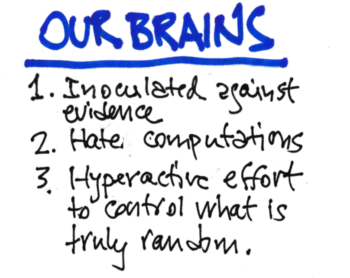

Why do investors pay fund and advisor fees that make no sense?

The last post said you will be a successful investor – almost certainly better than the 94th percentile of investors over time – by investing solely in Index funds. But very few individual investors do this. This post examines why they don’t simply stick

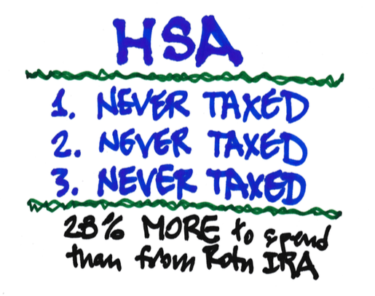

Do you properly pay yourself in retirement? Most don’t.

If we are to truly enjoy our retirement, we must properly pay ourselves from our nest egg. We first need to pay the right amount each year – our annual Safe Spending Amount (SSA). (See Chapter 2, Nest Egg Care (NEC); see here for

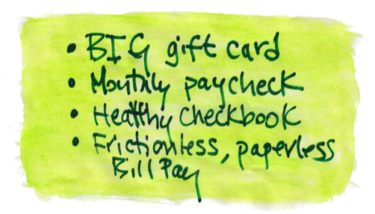

Do you think of your annual pay from your nest egg as “use it or lose it?”

A couple of weeks ago I mentioned this book, Dollars and Sense. I liked its thinking in Chapter 6. That chapter says that we are happier if we disconnect what we are buying from the action of actually paying for it. “We feel better