Category Archives: Uncategorized

Why is the your SSR% I provide in Nest Egg Care safer than you may have thought?

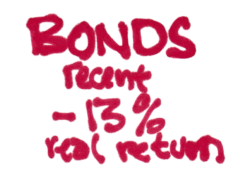

When I wrote Nest Egg Care (NEC), I used data for stock and bond returns starting from 1926. I displayed FIRECalc results for 72 23-year sequences in Graph 2-4. I highlighted the most harmful sequence – a blue line on that graph – as