Is it time to get a mortgage or refinance your current mortgage?

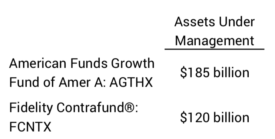

Is this a crazy question to ask someone who is retired or nearly retired? No! Mortgage rates now are low, low, low. The average 30-year mortgage now is about 3.7%. I summarize data from this graph that shows rates are within .4% of their lowest